How To Tap Equity in a Vacation Home

Cash-out refinance, HELOC, or STR loan? What are the options to get cash from your vacation property equity?

Cash-out refinance, HELOC, or STR loan? What are the options to get cash from your vacation property equity?

Surprisingly, most lenders let you "cash out" your rental property. Check maximum loan amounts, rates, and rules.

A HELOC is better than a cash-out refinance...except when it's not. Four situations and which loan product to use.

A remodel can increase your home value enough to do a cash-out refinance. Reimburse your renovation costs and accomplish other financial goals.

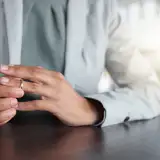

Buying out an ex-spouse with a refinance is less expensive, thanks to Fannie Mae's equity buyout rule.

Turning your auto and home loans into one low-rate mortgage sounds appealing, but is this a good idea?

Current guidelines for cash-out refinance loans from Fannie Mae and Freddie Mac.

Tapping into your home equity to buy a second home can provide a vacation spot and, surprisingly, generate rental income.

This website uses technologies such as cookies and pixels to improve site functionality, as well as for analytics and advertising. By continuing, you agree to our use of cookies and pixels. Learn more about our use of cookies and pixels in our privacy policy.