Two Hearts, One Mortgage: 10 Best Cities for Couples to Buy a Home

We analyzed 100 housing markets to determine where homebuyers with dual incomes have the best chance at homeownership.

We analyzed 100 housing markets to determine where homebuyers with dual incomes have the best chance at homeownership.

Get your printable home inspection checklist PDF and learn why a home inspection is so vital to the buying process.

It's possible to receive gift funds that would cover your entire FHA down payment, but you must follow guidelines, especially ones about acceptable donors.

A Mortgage Credit Certificate (MCC) is a federal tax credit program that allows eligible first-time homebuyers to claim a portion of their annual mortgage interest as a dollar-for-dollar reduction on their federal taxes. Issued by state or local governments, MCCs help make homeownership more affordable but are not loans or direct payments.

Fannie Mae’s HomePath program offers bargain hunters the opportunity to purchase foreclosed homes at discounted prices, but only during the "First Look" period.

While experts recommend spending no more than 36% of your income on housing and debt payments, it can be an unrealistic number in many markets. Lenders allow up to 50% or higher in some cases.

Gift money can come from relatives and even friends in some cases. It can cover your down payment and/or closing costs, reducing or eliminating the cash you need to close the home purchase.

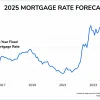

Nearly every major agency is predicting rates in the 6s or higher for 2025. But could rates drop into the 5s? There's a solid case for that argument.

A home equity loan is a type of second mortgage, which is a loan that's secured by the underlying property.

A mortgage escrow is an account set up by your lender to collect certain required homeownership expenses, such as property taxes and insurance premiums, to make sure they get paid and to simplify payment for the homeowner.