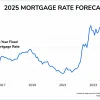

Mortgage Rates Today, December 26, 2025: No Reason to Expect Volatuility Today

Skeleton staffs on Wall Street and a lack of new economic data make the chances of an exciting day for mortgage rates slim.

Skeleton staffs on Wall Street and a lack of new economic data make the chances of an exciting day for mortgage rates slim.

According to National Association of Realtors® research, a 1% decrease in rates could add about 5.5 million households ... to the pool of potential buyers.

Major agencies expect rates to hover around 6.2% in 2026. On-the-ground industry experts say this sideways rate movement will help balance the market.

With mortgage rates at 6.5%, expect a boom in refinances and home purchases.

First-time home buyers are biding their time, put off by high mortgage rates. But is that a mistake they'll later regret?

Two expert forecasts this week provide hope that mortgage rates could fall later this year and through 2026.

Requesting seller concessions to pay for a rate buydown can lead to greater monthly and lifetime savings than requesting a lower purchase price.

Nearly every major agency is predicting rates in the 6s or higher for 2025. But could rates drop into the 5s? There's a solid case for that argument.

Experts tell you to shop for mortgage rates. But it could put your homebuying at risk. How do you shop lenders when buying a house?

As expected, the Fed cut its key interest rate by 0.25%. But mortgage rates might rise due to new Fed guidance for 2025.

Trump told rally-goers in Arizona that mortgage rates would fall to 2% during his presidency. Is that anywhere near possible?

Trump will be the president for the next four years. What that could mean for mortgage rates.

Mortgage rates have been on a roller coaster of late. What might 2025 bring for rates?

The Fed issued an anticipated rate cut, but it was bigger than many expected. How mortgage rates are reacting.