Mortgage Rates Today, Oct. 10, 2024: Warmer-Than-Expected Inflation Probably Bad for Mortgage Rates

The average 30-year fixed rate mortgage is 6.55% today, an increase of 0.01% since yesterday. The 15-year fixed mortgage rate stands at 5.65%, up by 0.02%. The 30-year FHA mortgage now averages 5.83%, having risen by 0.02. Meanwhile, the 30-year jumbo mortgage rate is 7.13%, reflecting an increase of 0.1%.

In brief

We're coming to you later than usual this morning to bring you the outcomes of this morning's consumer price index (CPI). The details are below, but we're expecting the data to be mildly bad for mortgage rates.

Yesterday, we mentioned the presidential race as a source of uncertainty for markets that adds to their list of known unknowns. Later that day, The New York Times carried a story under the headline, "Why the Election Has Wall Street Frozen."

"In interviews, bankers, lawyers and advisers who support both candidates, as well as those still undecided, listed a number of outstanding political questions that could create or wipe out fortunes," said the Times. "Would corporate taxes rise or fall? Would Vice President Kamala Harris’s proposals to tackle inflation crack down on profits? Which version of Mr. Trump would show up in office?"

Meanwhile, we're all thinking of friends and family in Florida who might be caught up in the effects of Hurricane Milton. But these natural disasters can affect markets, too. You can imagine the impact of Hurricanes Helene and Milton on Florida's productive capacity, at least in the short term.

We mention these only to stress that economic data aren't the only things that can affect mortgage rates. Yes, figures such as this morning's inflation numbers typically have the biggest effect. But there are a lot of other factors in play, too.

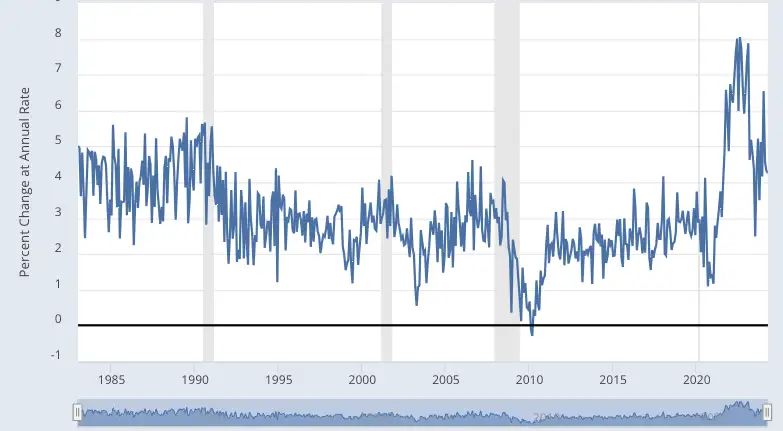

Mortgage Rate Trends: Past 90 Days

Purchase Rates

| Loan Type | Rate | APR | Daily Change | Monthly Change |

|---|---|---|---|---|

| 30-Year Fixed | 6.55% | 6.58% | +0.01% | +0.84% |

| 15-Year Fixed | 5.65% | 5.71% | +0.02% | +0.89% |

| 30-Year Fixed FHA | 5.83% | 6.66% | +0.02% | +0.74% |

| 30-Year Fixed VA | 5.96% | 6.12% | +0.03% | +0.89% |

| 30-Year Fixed USDA | 5.72% | 5.86% | +0.02% | +0.63% |

| 30-Year Fixed Jumbo | 7.13% | 7.15% | +0.1% | +0.79% |

| 5/6 Year ARM | 6.56% | 6.62% | -0.02% | +0.34% |

Refinance Rates

| Loan Type | Rate | APR | Daily Change | Monthly Change |

|---|---|---|---|---|

| 30-Year Fixed | 6.54% | 6.58% | +0.02% | +0.73% |

| 15-Year Fixed | 5.49% | 5.55% | +0.03% | +0.73% |

| 30-Year Fixed FHA | 5.82% | 6.65% | +0.02% | +0.72% |

| 30-Year Fixed VA | 5.97% | 6.12% | +0.03% | +0.88% |

| 5/6 Year ARM | 6.74% | 6.81% | +0% | +0.39% |

Coming up

Mortgage rates today

Only a couple of months ago, consumer price indexes were the most consequential of all economic reports for mortgage rates. But then price rises slowed and the focus of the Fed and markets switched to jobs reports.

Still, today's CPI for September remains by far the most potentially influential report this week.

The report has four headline figures. Two cover the reporting month (September) and two others are year-over-year (YOY) numbers (Oct. 1, 2023, to Sep. 30, 2024).

One for each period measures changes in all the prices in the survey. And the other shows the same after stripping out food and energy prices. That latter one is called "core" CPI because it reveals the underlying trend after excluding the most volatile prices.

With inflation reports, mortgage rates are likely to drop if numbers are lower than markets are expecting. But those rates could rise if they're higher. And a report that exactly matches forecasts is often a non-event.

We're showing this morning's actual figures in bold, alongside what MarketWatch says markets were expecting before publication:

- September CPI — 0.2% actual. Markets were expecting 0.1%, down from August's 0.2%

- September core CPI — 0.3% actual. Markets were expecting 0.2%, down from August's 0.3%

- YOY CPI — 2.4% actual. Markets were expecting 2.3%, down from August's 2.5%

- YOY core CPI — 3.3% actual. Markets were expecting 3.2%, unchanged from August

You can see that all four figures were very slightly worse than markets were expecting. And that would normally exert upward pressure on mortgage rates.

However, one can never be 100% sure how markets will react to key economic reports. And occasionally they seem to respond perversely.

This morning also brought the initial claims for unemployment benefits during the week ending Oct. 5. These used to be dismissed as irrelevant by most investors. But now employment is front of mind, they can have some effect on mortgage rates.

This morning's figure was "the highest level for initial claims since August 5,

2023," according to the Department of Labor. And that might help offset the CPI's upward pressure on mortgage rates. But we shall be surprised if it's enough to keep mortgage rates from rising today.

Friday

The producer price index (PPI) for September is due tomorrow. It's the CPI's weedy little brother, with much less potential to affect mortgage rates than his big sister.

Still, the PPI can have some impact so it's worth watching. It's built the same way as the CPI (see above) with four components. But, because it's less important, MarketWatch doesn't give market expectations for year-over-year figures.

So, here's what's currently expected for September's PPI:

- September PPI — Markets expecting 0.1%, down from August's 0.2%

- September core CPI — Markets expecting 0.2%, down from August's 0.3%

The rules are the same. For mortgage rates to fall, we'll likely need lower numbers than markets are expecting.