Can You Get a Barndominium for Zero Down With a USDA Loan?

It's possible to buy or build a barndominium with a zero-down USDA loan. But expect some serious legwork to find a lender and builder.

If living in the country is on your vision board, you might be able to make that dream a reality with a government-backed USDA loan to buy or build a barndominium. This 0% down mortgage option can help you build or buy a barndominium, as long as you meet borrowing guidelines and the property and location qualify for USDA financing.

The term “barndominium” is the combination of “barn” and “condominium” — or “barndo” as it’s called by enthusiasts. But in reality, it’s like neither structure. It’s usually made of steel with a sprawling floor plan, most often a new build instead of a barn conversion, as the name suggests. The home type often comes with lower construction and material costs, making them an affordable alternative to a typical stick-built, single-family home.

USDA loans can finance barndominiums that meet residential property standards and are located in eligible rural areas.

No down payment is required, making barndominiums more accessible to first-time rural homebuyers. However, you’ll need a credit score of 640 or higher to qualify.

USDA construction loans are available but may be harder to find than traditional USDA purchase loans.

USDA Loan Requirements for Barndominiums

Using a USDA loan, which is backed by the U.S. Department of Agriculture, to finance your barndo is slightly different from a vanilla conventional mortgage.

Here’s a look at some key requirements:

Property Requirements:

Barndo must be affixed to a permanent foundation that meets HUD standards

Property must have access to residential utilities, including water, electricity, and sewage

Year-round property accessibility

Must be a residential property (vacation and rental properties don’t qualify)

Located in a USDA-eligible rural area

Meets local building codes and zoning requirements

USDA Borrower Requirements:

Income falls within the USDA limit of 115% of area median income.

Credit score of 640 or higher (some lenders may allow lower scores)

Debt-to-income (DTI) ratio under 41%, which some exceptions for strong applicants

Must be a U.S. citizen or permanent resident

Must intend to use barndo as a primary residence

The USDA’s Property and Income Eligibility tool allows you to check if your income and the property are eligible for USDA financing. According to the USDA, 97% of U.S. land qualifies for USDA loans, making barndominium financing widely accessible in rural areas.

Related: Family Builds Barndominium For 1/3 the Cost of Stick-Built Home, Says Others Can Do It Too

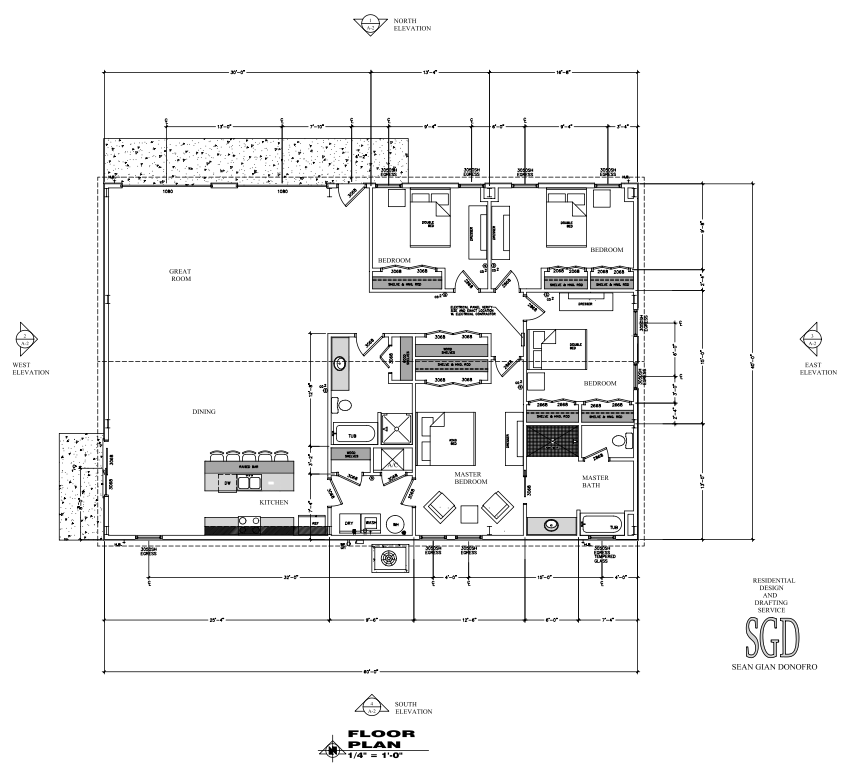

A floorplan of a barndominium being built near Altha, Florida. Read more about this build.

The Benefits of Using a USDA Loan for a Barndominium

USDA loans offer several advantages that make them a worthy option for barndominium buyers. These include:

No Down Payment Requirement: Unlike conventional and FHA loans requiring 3% to 3.5% down, USDA finances loans at 100% with zero down.

Competitive Interest Rates: USDA rates are often lower than conventional interest rates.

Lower Mortgage Insurance: You’ll pay an annual USDA insurance guarantee of 0.35% of the loan amount versus the steeper annual MIP of 0.50% to 0.75% on a 30-year FHA loan. That’s in addition to USDA’s upfront 1% guarantee fee compared to FHA’s 1.75% of the loan amount.

Building a Barndominium with a USDA Loan

USDA construction loans are somewhat hard to find; not all lenders offer USDA financing, much less a USDA construction loan. In fact, at the time of this writing, there were only about 25 approved USDA construction lenders in the entire U.S.

If you can find a lender, you may be eligible for USDA’s construction-to-permanent loan that combines the loan amount to finance your barndo build and the permanent loan all into one closing. You can also finance the purchase amount of the land you plan to build on.

"We could finance the construction [and purchase] all in one loan, as long as it's completed in 12 months, and we get the certificate of occupancy. Then we modify that construction note to a 30-year, fixed-rate mortgage.”

Here are key considerations for a USDA construction loan for a barndominium:

Requires a licensed builder with proven track record

Draw schedule must be approved by lender in advance

Construction must be completed within 12 months

Contractor must provide a detailed cost breakdown

Plans must meet all USDA property requirements

Property will require an appraisal upon completion

Can You Run a Business From the Barndominium?

USDA guidelines allow for mixed-use properties — one that pulls double-duty as a home and a business. However, there are some caveats:

Business use must be secondary to primary residential use

Property must be primarily owner-occupied

Income-producing activities must be incidental and minimal

Home-based businesses that don’t require commercial property features are allowable

For example, a barndominium with a home-based coaching business or small workshop would likely qualify, while one primarily used for commercial farming operations would not.

How USDA Loans for Barndominiums Differ from Conventional, FHA and VA Loans

How do you know if a USDA loan is your best option when stacked up against a conventional, FHA, or VA loan? Understanding the primary differences between these loan types can help you choose the best financing option for your barndo.

Here’s a look at each loan’s borrowing guidelines and benefits to compare how they measure up.

Property Eligibility:

USDA: Rural areas only, primary residence only

Conventional: Any location, including investment properties, within conforming loan limits

FHA: Any location, primary residence only, within FHA loan limits

VA: Any location, primary residence only, no loan limits with full VA entitlement

Minimum Down Payment:

USDA: 0% down

Conventional: 3% or 5% down

FHA: 3.5% down (with 580 or higher FICO); 10% down (with 500-579 FICO)

VA: 0% down with full entitlement

Minimum Credit Score:

USDA: Typically 640 or higher

Conventional: 620 or higher

FHA: 500-579 (with 10% down); 580 or higher (with 3.5% down)

VA: Not set by VA, but approved lenders typically prefer 620 or higher

Construction Loans:

USDA: Limited availability through approved USDA lenders

Conventional: Widely available through most lenders. Check out our guide to conventional construction loans to learn more.

FHA: Available through approved FHA lenders. Check out our guide to FHA construction loans to learn more.

VA: Available through approved VA lenders

Energy Efficiency Benefits:

USDA: Use a USDA renovation loan for certain energy-efficient upgrades

Conventional: Fannie Mae's HomeStyle Energy Mortgage or Freddie Mac's GreenCHOICE Mortgage

Pros and Cons of Barndominiums

Pros:

Lower construction costs than traditional homes

Faster build time (up to six months versus seven to 14 months for traditional homes)

Energy efficient due to metal construction

Flexible, open floor plans

Durable materials requiring less maintenance

Cons:

Limited lender familiarity may complicate financing, making it harder to find

May face zoning restrictions in some areas

Resale market may be smaller and there may not be enough comparable properties for appraisal

Insurance can be costlier and harder to get, especially for mixed-use barndos

How to Get a USDA Loan for a Barndominium

To get a USDA loan for your barndo, here are some key steps to follow:

Verify Property and Income Eligibility: Check your chosen location on the USDA eligibility map and confirm your household income falls within local limits. You'll also need to verify the property meets local zoning requirements for residential construction.

Shop Around With USDA-Approved Construction Lenders: Find lenders who specifically offer USDA construction loans and have experience with barndos. USDA maintains a list of lenders who are active and approved for the construction-to-permanent product. Contact multiple lenders to compare rates, terms, and their familiarity with barndo builds.

Get Construction Bids from Licensed Builders: Ask for detailed bids from as many barndo builders as you can find in your area. Note, that may only be one, and in some cases, none. The builders must be licensed, have experience with barndominiums and can meet USDA construction standards. Each bid should include a detailed cost breakdown and construction timeline.

Request Complete Building Plans: Work with your builder to create detailed barndo construction plans that meet all USDA requirements, including permanent foundation specifications and USDA property safety and habitability standards. These plans must be approved by local building authorities and your lender before loan approval.

Apply For a USDA Loan: Provide all required financial documentation, including tax returns, pay stubs, bank statements, and a detailed construction contract. Your lender will also need site plans, building permits, and contractor credentials.

Review the Loan Draw Schedule and Construction Timeline: Work with your lender and builder to establish a clear draw schedule that outlines when funds will be released during your barndominium’s construction. Understand the inspection requirements that must be met before each draw.

Close on the Construction Loan: Attend the closing to sign all required documentation and review final terms. Be prepared to pay any required closing costs or fees.

Monitor Building Progress: Stay actively involved during the build, attending required inspections and reviewing your builder’s progress. Keep detailed records of all changes or modifications to the original plans. Your builder must finish the project within 12 months of your construction loan’s closing date.

Convert to Permanent Financing: Once construction is complete and final inspections are passed, work with your lender to convert the construction loan to permanent USDA financing. This typically requires a final inspection of your barndo and a certificate of occupancy.

If you’re using a USDA loan to buy an existing barndominium, you’ll follow the same steps as above (minus the ones involving a builder). However, the property will need to be appraised, which might be difficult if you’re in an area lacking comparable properties, Stroud notes.

Sustainability and Affordability: Why Barndos Align with USDA Goals

Barndominiums go hand-in-hand with USDA's mission of promoting affordable, sustainable rural housing. Because most barndos are made with a steel envelope, they offer better energy efficiency and durability than many traditional stick-built homes.

Energy-efficient features that can strengthen loan eligibility:

Insulated metal panels

ENERGY STAR-rated appliances and electronics

Smart/programmable thermostats

LED lighting systems

Energy-efficient windows, doors and insulation

If you’re buying an existing barndominium, the USDA offers a rehabilitation loan program that allows you to finance up to 100% of the “as-improved” market value after renovations. This can include certain energy-efficient upgrades, such as new windows, doors, and other green-home improvements.

Additionally, you might be eligible for a federal tax credit of up to $3,200 for qualified energy-efficient home improvements made through 2032.