Why Are Home Prices So Unaffordable in the Western U.S.?

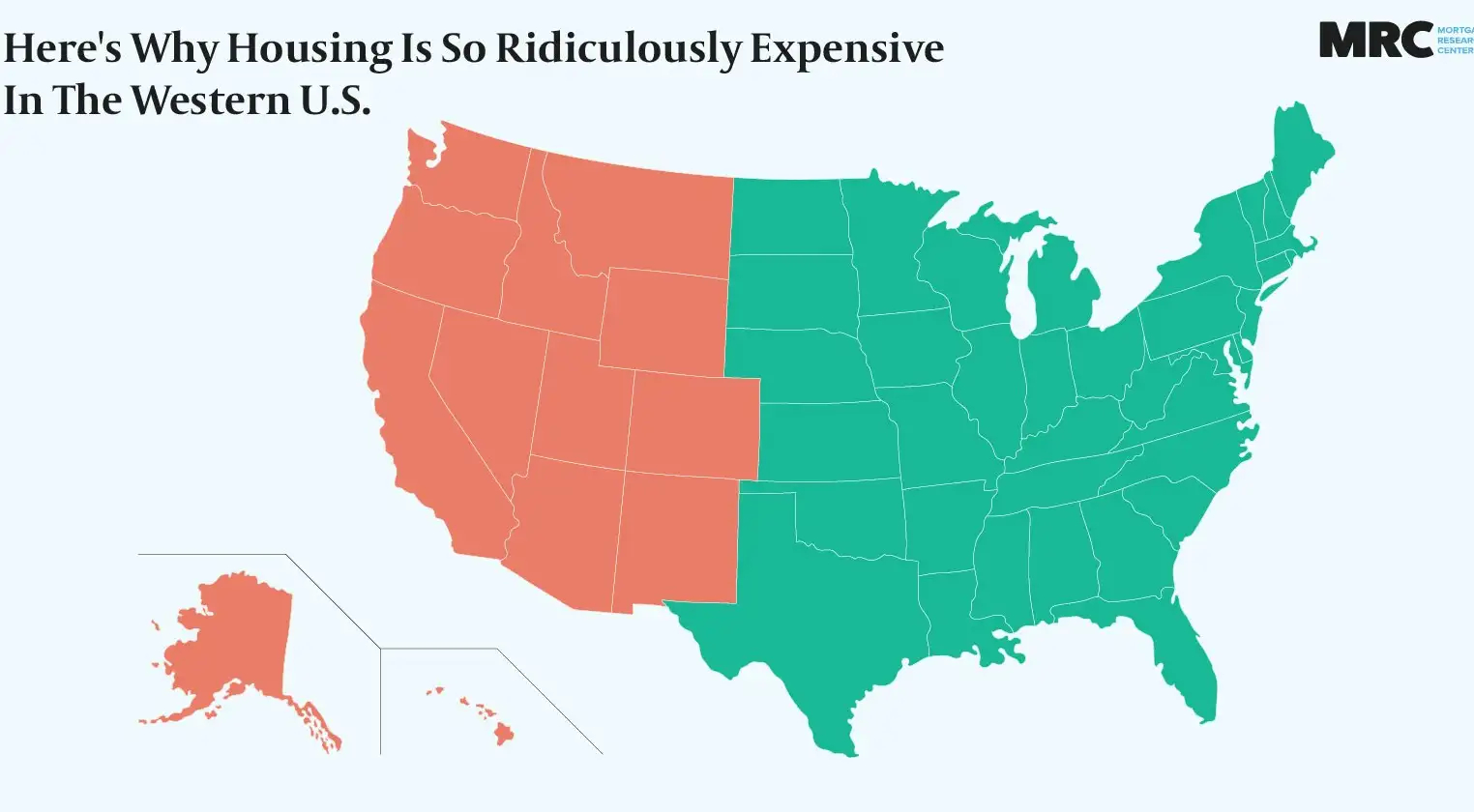

Two-thirds of Americans live east of the Mississippi River.

These more crowded states in the East should have higher home prices, right?

Wrong. Homes in Western states, especially those west of Texas as in the above map, cost more — sometimes a lot more. What’s going on?

Comparing Median Home Prices By State

These two numbers illustrate the starkest contrast between U.S. home prices in the East and West.

$793,600: The median home price in California

$232,800: The median home price in Mississippi

But this comparison does not help explain why Western homes cost more. The states of Mississippi and California have different economies, histories, and populations.

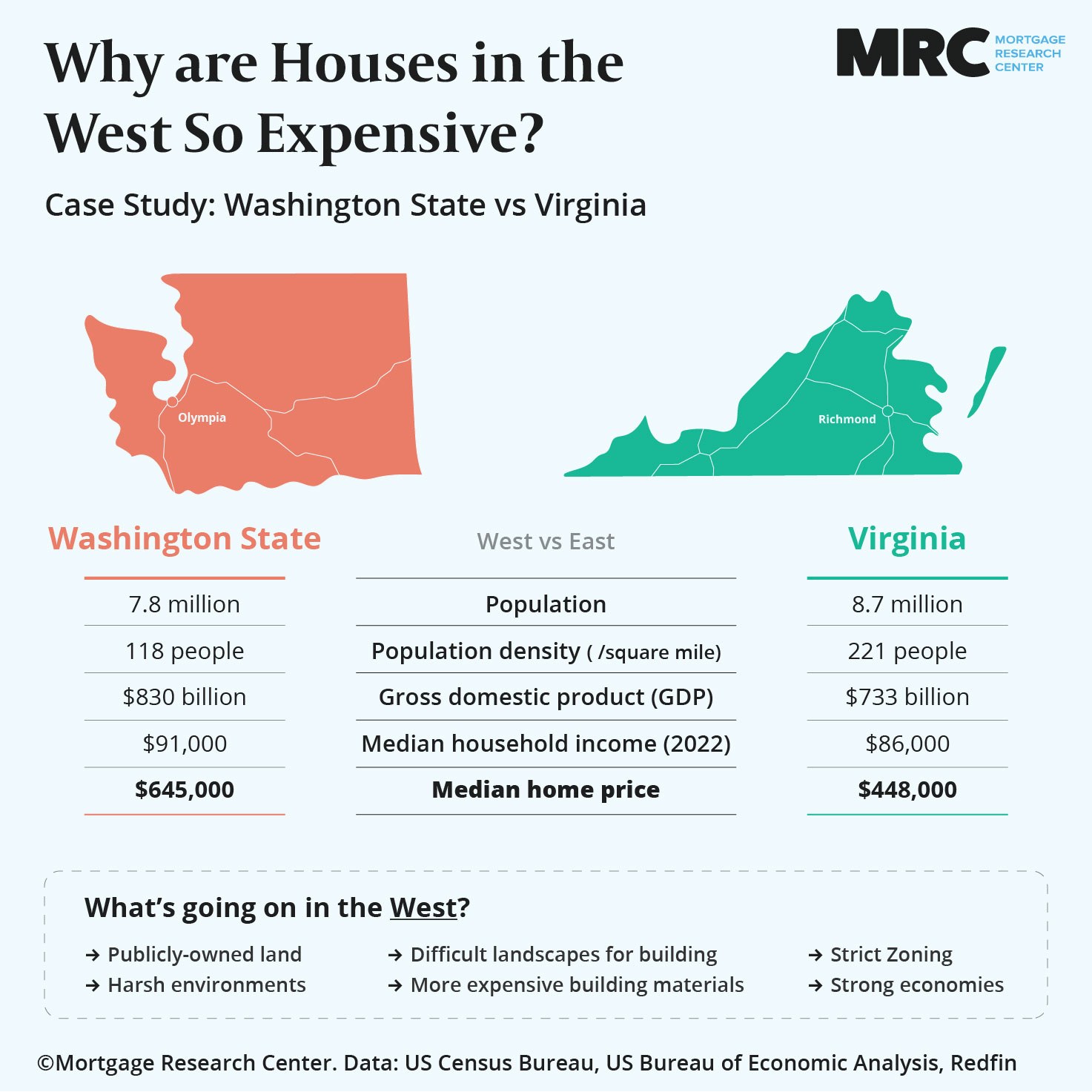

We can learn more by comparing states that are more alike demographically and economically. Let’s take Washington State in the West and Virginia in the East.

Homes in Washington cost almost 50 percent more than homes in Virginia even though Virginia has almost twice as many residents per square mile. This means homebuyers in Washington have to come up with 50 percent more despite earning a similar annual income.

What Drives Up Home Prices In The West?

The infographic above shows the challenges people in many Western states such as Washington face when they’re saving money for a home, but it doesn’t explain why this challenge exists.

Here are some factors that drive up Western home prices:

Public Ownership Of Land

The federal government owns a lot more land in states located west of the Mississippi River. For example, the federal government owns almost 30 percent of all acreage in Washington State. In Virginia, even with its proximity to the nation’s capital, the federal government owns less than 10 percent of the state’s land.

And, the state government in Washington owns another 6 percent of the state’s acreage. Virginia’s state government owns very little land.

Public-owned land, since it’s off limits to home builders, increases the price of available lands and existing homes.

The Landscape

Eastern states are home to forests, farmlands, and rolling hills — the kind of landscape that’s easy enough to turn into large neighborhoods full of single- and multi-family housing developments and shopping centers.

Western states, in general, have more dramatic landscapes. In Washington, the Cascade and Olympic mountain ranges have never been ideal for large-scale home building. Steep slopes, rocky soil, and the difficulty of installing public utilities increases prices or make building impossible.

Less available land to build new housing makes existing homes more valuable.

Environmental Fluctuations

Southern California's climate may be the envy of many, especially during the winter, but not every Western state is so hospitable. Desert conditions in the Southwest, harsh winters in the Rockies, earthquakes, and unpredictable fires and mudslides threaten homes and limit building sites.

Plus, homes must be built with these perils in mind. This can increase building costs.

Zoning Regulations

Local governments in Western states are more likely to control what kind of homes can be built in what areas. Some neighborhoods in the San Francisco Bay Area, for example, won’t allow multi-unit housing. This keeps people more spread out and increases prices for existing homes in those neighborhoods.

New York Times opinion columnist Ezra Klein discusses the role these rules have on home prices on his podcast.

Transporting Building Materials

There’s more space in the West, which means building materials must travel greater distances to reach building sites.

And, Western housing markets tend to be located farther from sea ports, river ports, and railroads compared to markets in the East and Midwest. This means materials have to travel in smaller quantities across the land by truck.

The availability of building materials helps drive price-per-square-foot building costs to $315 in Washington while they’re $218 in Virginia.

Strong Economies

Places like San Francisco and Seattle are known as tech hubs where the likes of Google, Amazon, and Microsoft pay employees top dollar. As incomes rise, so do local home prices.

California alone has a bigger economy than Great Britain according to Investopedia, employing millions of workers in tech, entertainment, and international trade.

New York City and surrounding areas have nearly as big an economy as California. Yet, 90% of jobs in the city are in finance, says Investopedia. To be clear, the East has its share of high-paying jobs and expensive cities as well. But with fewer of the aforementioned expense-adding factors, homebuyers have more options outside of major metros.

All These Factors Combined

A quick glance at a map shows lots of room for expansion in the West. But this appearance is misleading. Many large cities west of the Mississippi struggle to find room for new housing developments.

Builders are boxed in by public and conservation lands, natural barriers like mountains and lakes, and human-made barriers like zoning rules.

All these factors combined help create and sustain a housing supply shortage. The law of supply and demand says shortgages increase prices. That’s true for housing just like it’s true for concert tickets and gasoline.

Exceptions To The West-Costs-More Rule

What about New York City, New England, and South Florida — places in the East where home prices rival those in the West?

These exceptions prove the rule. It’s hard for home inventories in New York City, for example, to keep up with demand because of geographic restrictions (Manhattan is an island, after all).

Building regulations also play a role. South Florida is a fast-growing region that’s adjacent to conservation lands and bordered by water on three sides. In that sense, South Florida has more in common with the West than it has with other Southeastern states.

The Exceptions Flow Both Ways

In the West, buyers in New Mexico see median home prices of $358,600 — which is less than Virginia’s. And at $280,000, Nebraska’s median home price is among the lowest in the nation.

These markets resemble markets in the East with more open land for development and fewer building restrictions.

How To Buy An Expensive Home In The West

Home buyers in the West can’t change their geography. They can’t revert federal and conservation lands back to private ownership.

They can advocate for relaxing their area’s building and zoning laws. This could loosen up housing markets. But advocacy takes time, and housing markets change slowly even after rules change.

So how can Western home buyers buy a home despite their area’s higher home prices?

Save More Aggressively

An average home buyer in a state like Virginia who has $50,000 to $60,000 in savings will be well situated for buying a median priced home. The same home buyer in Washington State may need $100,000 to $120,000 to get the same leverage on a similar home.

Some Western home buyers accept this challenge and save more deliberately. They know becoming property owners in a high value market will pay off when they sell the home, so they find a way to save enough money.

Start Small

Other home buyers in expensive Western states use the foot-in-the-door technique. This means:

Buying a smaller, less-expensive home, often in a neighborhood that’s not their first choice

Paying the smaller home’s mortgage down as quickly as possible

Selling that smaller home

Using proceeds from the sale to help pay for a home that better resembles their dream home

This strategy can speed up home buying by bypassing years of rent payments, directing rent money into a future home investment.

Moderate-income homebuyers in USDA-designated rural areas can start this way without needing a down payment through the USDA Guaranteed Loan program.

Seek Help

Yes, Western-state homes cost more, but these states are also home to some of the nation’s best down payment assistance programs. Washington home buyers, for example, should check with the state’s Housing Finance Commission about help with a mortgage loan down payment.

California has similar programs. The California Dream For All program, for example, can help first-time buyers with up to 20 percent of the new home’s price.

Most other states have these kinds of programs, too. Some cities and local nonprofits offer separate programs to speed up the home buying process.

Other ways to get help:

Ask family or friends: Some people ask for down payment money in lieu of wedding gifts or graduation presents. Some people who know they’ll inherit significant money in the future ask for an advance to spend on housing. (This approach isn’t for everybody)

Use a federal loan: Military families can buy with no money down through the VA home loan program. Everyone can use the FHA program which requires only 3.5 percent down. Some buyers in rural areas can buy with no money down through the USDA program

Assume a loan: Assuming a mortgage is kind of like taking up payments on a friend’s car. It can be a sweet deal if you find it, especially if you assume a loan that originated in 2021 and early 2022 when rates kept setting historic lows

These methods can help overcome home buying challenges in the East, too.

The Right Mortgage Helps Lower Housing Costs

Another big variable affecting home prices: The mortgage loan used to finance the purchase.

Financing a home at a slightly lower interest rate can trim hundreds of dollars off a monthly payment, putting more Western homes within the reach of more Western home buyers.

Average mortgage rates climbed in 2023 and remained high during the first half of 2024, contributing to the high price of homes, but since then rates have started to decline, opening more doors.

In any rate climate, getting multiple loan quotes helps buyers locate their best rate.