FHA vs. Conventional Loans: The Biggest Differences

FHA and conventional loans are two of the most popular mortgage options, each with distinct advantages. FHA loans, backed by the government, cater to buyers with lower credit scores and smaller down payments, while conventional loans offer better long-term savings and flexibility for borrowers with strong credit and financial stability.

The two most popular loan options are conventional loans and FHA loans. So what are the differences and which one is better for you?

This comprehensive guide will explore the key differences, advantages, and potential drawbacks of both loan types, helping you make an informed decision about which of these two paths to homeownership is right for you.

Conventional Versus FHA: What’s the Difference?

The core difference is simple: FHA loans are insured by the Federal Housing Administration, a government entity, while conventional loans are not. This means FHA loans have more flexibility for credit scores, income types, and down payments.

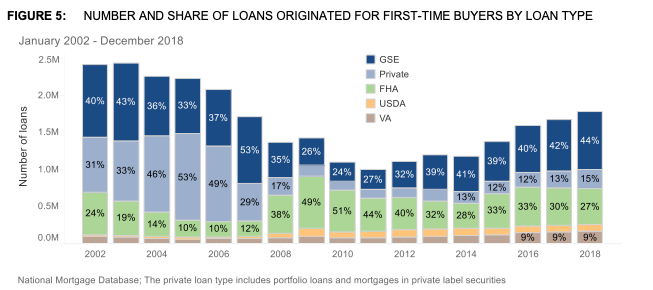

And while some buyers might assume FHA loans are exclusively for first-time homebuyers and conventional mortgages are geared toward more experienced buyers, this isn’t always the case.

What Is an FHA Loan?

An FHA loan is a mortgage insured by the Federal Housing Administration, designed to make homeownership more accessible, particularly for mortgage borrowers with lower credit scores or less savings.

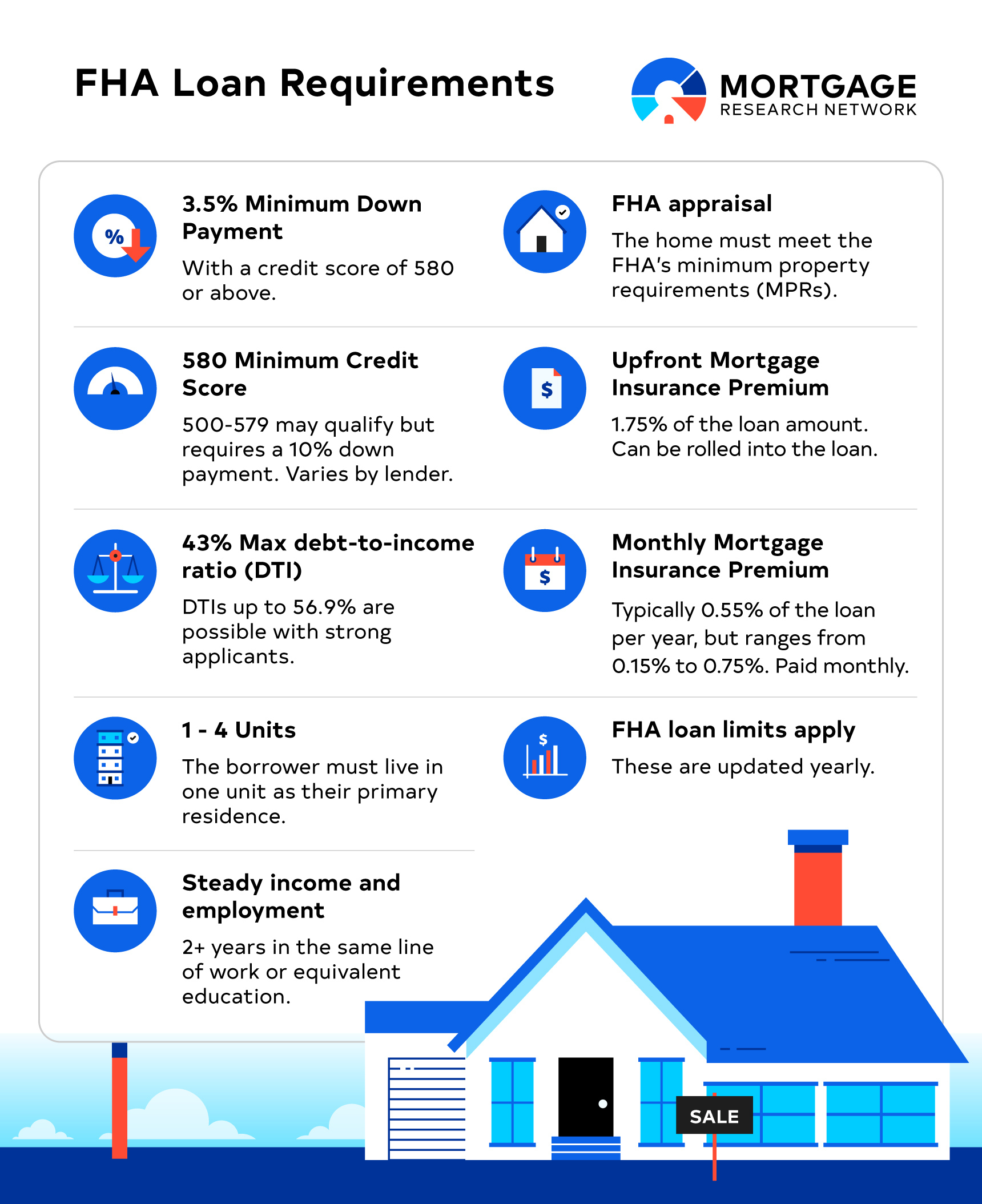

Key Features of FHA Loans

Low Down Payment: Buyers can secure an FHA loan with as little as 3.5% down if they have a credit score of 580 or higher.

Flexible Credit Requirements: FHA loans are more forgiving of past financial issues, allowing scores as low as 500 with a 10% down payment.

Government Backing: The FHA doesn’t lend money directly; instead, it insures the loan, reducing the risk for lenders.

Who Benefits Most from FHA Loans?

Some home buyers may believe that FHA loans are only meant for first-time buyers. However, with their low down payment requirement and recently reduced mortgage insurance premiums, FHA loans have increasingly grown in popularity with move-up buyers. FHA loans have no income caps and no minimum income amounts required.

FHA loans can be particularly appealing to:

First-time homebuyers with limited credit history.

Buyers with lower credit scores.

Homebuyers with higher debt-to-income ratios.

Borrowers with less savings.

FHA Mortgage Insurance

One drawback of FHA loans is the mandatory mortgage insurance premium. Conventional loans only require monthly mortgage insurance, known as Private Mortgage Insurance (PMI). FHA loans, on the other hand, have two types of mortgage insurance.

Upfront Mortgage Insurance Premium (UFMIP): 1.75% of the loan amount, typically added to the loan balance, meaning you’ll finance the upfront MIP each month as part of your mortgage payment.

Annual Mortgage Insurance Premium (MIP): Paid monthly, this insurance is 0.55% per year (calculated by multiplying the base loan amount times .0055 and then dividing that number by 12) and lasts for the life of the loan unless refinanced into a conventional loan.

What Is a Conventional Loan?

Offered by a wide range of lenders across the U.S., including banks, credit unions, and online mortgage providers, conventional loans are the standard mortgage most people think of when it comes to home loans.

They are mortgages that are not insured or guaranteed by any government agency. Since they aren’t government-backed loans, the lender assumes all the risk associated with a conventional loan.

Key Features of Conventional Loans

Flexibility in Property Types: Can be used for primary residences, second homes, and investment properties.

No Mortgage Insurance with 20% Down: Avoids the added cost of private mortgage insurance (PMI) if you can put down at least 20%.

Higher Credit Standards: Typically require a minimum credit score of 620, but borrowers with excellent credit receive better rates and terms.

Widely Available: Conventional loans are offered by most banks and lenders.

Conforming vs. Non-Conforming Loans

Offered by private lenders, conventional loans can be conforming or non-conforming. Non-conforming loans are a subset of conventional loans, as they are not government-backed but deviate from conforming loan requirements.

Conforming Loans: Complies with the financial and funding boundaries laid out by the Federal Housing Finance Agency (FHFA) and meets the guidelines set by Fannie Mae and Freddie Mac, including loan limits ($806,500 in most areas for 2025, higher in high-cost areas).

Non-Conforming Loans: Does not comply with the parameters established by FHFA. Cannot be sold to Fannie Mae and Freddie Mac. The most common type of non-conforming loan is known as a jumbo loan. These are considered non-conforming because they fail to meet required loan limits.

Who Benefits Most from Conventional Loans?

Mortgage borrowers with strong credit, a solid income, and at least 3% for the down payment are the best candidates for a conventional home loan. Both first-time and experienced home buyers can qualify if they meet the requirements.

Conventional loans are great for:

Buyers with solid credit scores and financial stability.

Those who can afford a larger down payment.

Individuals seeking to invest in properties or purchase second homes.

FHA vs. Conventional Fast Facts

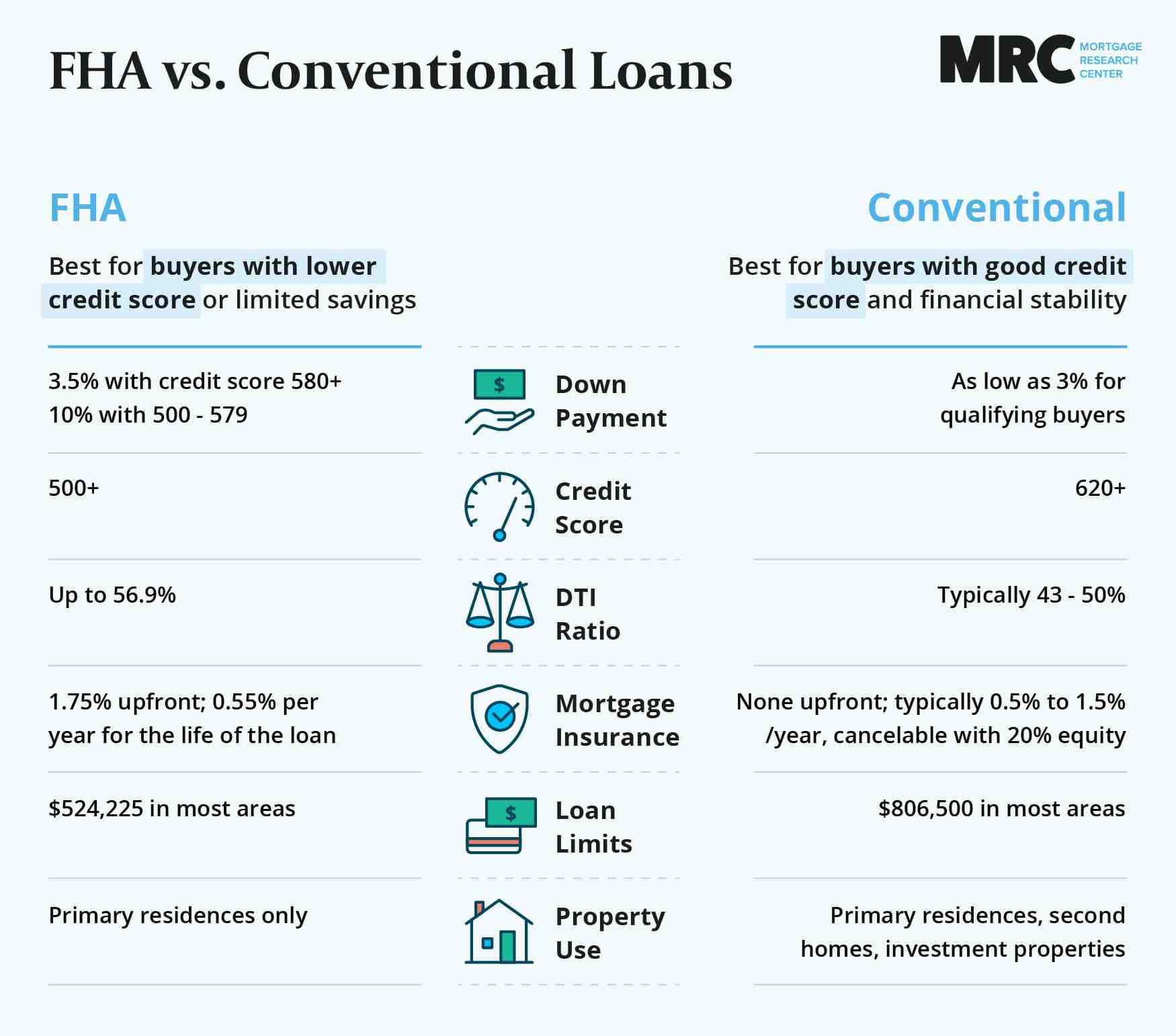

FHA Loan | Conventional Loan | |

|---|---|---|

Down Payment | 3.5% minimum | As low as 3% |

Credit Score | 580+ for 3.5% down; 500-579 for 10% down | Typically 620+ |

Debt-to-Income Ratio | Up to 56.99% | Typically 43%-50% |

Upfront Mortgage Insurance | 1.75% of loan amount | None |

Monthly Mortgage Insurance | $46/mo. per $100k; Required regardless of down payment | $40-$125 or more per $100k; Required if down payment is less than 20% |

Interest Rates | Lower than conventional for borrowers with lower scores | Similar to FHA for borrowers with higher scores |

Loan Limits | $524,225 | $806,500 |

Lenders | Most lenders offer FHA | Most lenders offer conventional |

Tip: FHA loans tend to be better for homebuyers with lower credit scores, higher debt-to-income ratios, and limited down payment funds (below 5%). Conventional loans are better for buyers with excellent credit, lower debt ratios, and at least 5% or more for their down payment.

Credit Score Requirements for FHA vs. Conventional Loans

When it comes to getting a mortgage, credit scores play a significant role in determining loan eligibility and interest rates.

FHA Loans

580+ Credit Score: Qualifies for the 3.5% minimum down payment.

500-579 Credit Score: Requires a 10% down payment and may involve stricter underwriting.

Conventional Loans

620 Minimum Score: Most lenders require at least this score.

740+ Credit Score: Unlocks the best interest rates and loan terms.

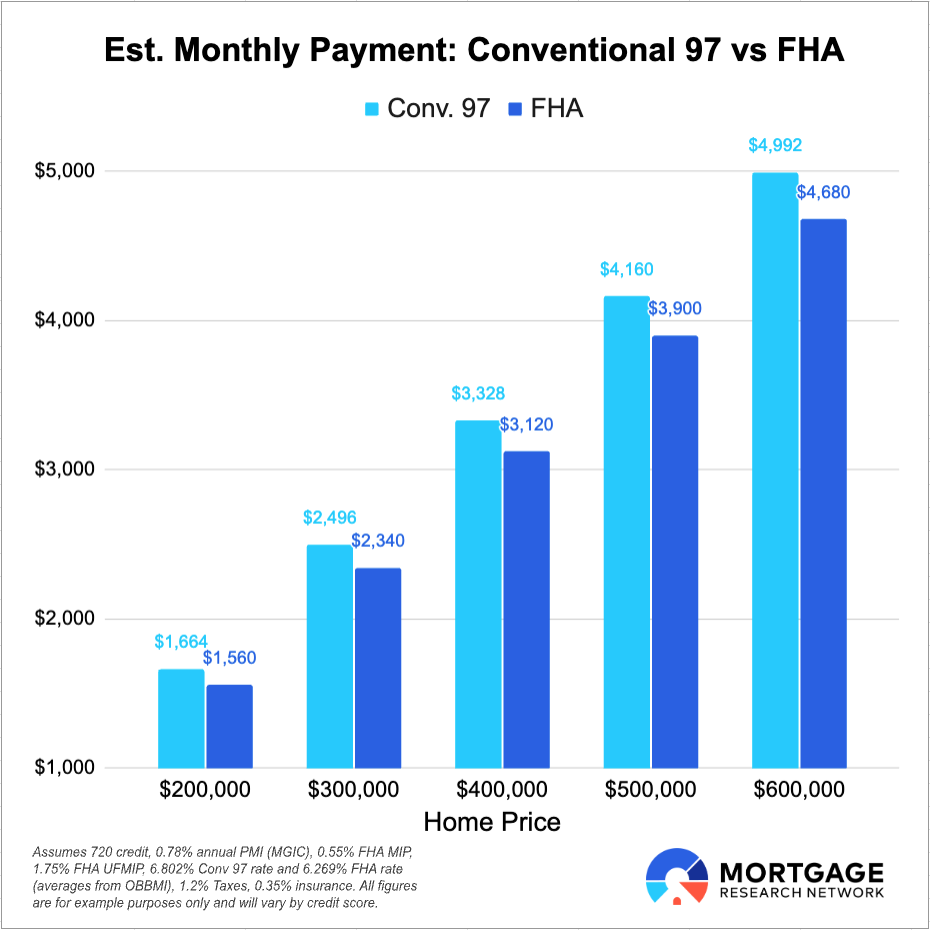

In the chart below, a 720-credit homebuyer could potentially qualify for a conventional loan. But they might opt for FHA when they recognize a conventional loan will cost more due to higher rates and mortgage insurance fees.

Tip: Borrowers with credit scores on the lower end may still qualify for a conventional loan, but FHA loans tend to offer better rates for those in this range. You can find a more in-depth look at credit score requirements for FHA vs Conventional here.

Down Payment Requirements for FHA vs. Conventional Loans

The down payment is a critical factor, especially for first-time buyers. Both FHA and Conventional loans offer low down payment options.

FHA Loans Down Payment

Minimum 3.5% for credit scores of 580 or higher.

10% for credit scores between 500 and 579.

Conventional Loans Down Payment

As low as 3% for qualifying buyers (e.g., Fannie Mae’s Conventional 97 program).

At least 20% to avoid private mortgage insurance (PMI).

While a 3% down payment on a conventional loan might seem like the better option, it often comes with hurdles that many buyers cannot overcome.

Most 3% down conventional loans impose income restrictions. For example, Fannie Mae’s HomeReady program requires your income to be no more than 80% of your area’s median income, and Freddie Mac’s Home Possible has the same limitation. The only exception is Freddie Mac’s HomeOne loan, which has no income caps.

See a detailed comparison of conventional 3% down programs here.

Additionally, qualifying for a conventional loan with just 3% down is more challenging. Mortgage borrowers often face stricter credit requirements and higher interest rates compared to those who can make larger down payments.

Another factor to consider is higher mortgage insurance costs for 3% down conventional loans. Data from MGIC, shows that borrowers pay about $60 more per month on a $350,000 loan with 3% down compared to 5% down.

In contrast, FHA loans offer easier qualification standards and lower, standardized mortgage insurance costs. For just an additional 0.5% down—equivalent to $1,750 more on a $350,000 loan—FHA borrowers gain access to competitive rates and less stringent approval requirements.

Interest Rates: How Much Do They Differ?

Rates for FHA loans can be lower than the rates offered for conventional loans. However, even with slightly lower base rates, the added cost of mortgage insurance can make them more expensive over time.

As an example, if your down payment is less than 10% on an FHA loan, you'll be required to pay mortgage insurance for the entire life of the loan unless you refinance. Even with a 10% or larger down payment, FHA mortgage insurance remains for at least 11 years.

As a result, the initial savings from a lower interest rate may be offset by ongoing mortgage insurance costs, especially after you've built significant equity in your home.

The rates for conventional loans are more credit-sensitive, meaning mortgage borrowers with excellent credit will be rewarded with lower rates.

When comparing interest rates for FHA and conventional loans, calculate how quickly you'll reach 20% equity. If you anticipate achieving this milestone in less than 11 years, the potential savings from a lower FHA interest rate may not outweigh the added cost of long-term mortgage insurance.

Mortgage Insurance

Whether you choose an FHA loan or a conventional loan, unless you put 20% down, you’ll be required to pay mortgage insurance.

There are two primary differences when it comes to mortgage insurance with these two types of loans.

FHA mortgage insurance is paid over the life of the loan, whereas conventional mortgage insurance can be canceled after your home has sufficient equity.

Conventional mortgage insurance will cost you more if you have lower credit scores; FHA mortgage insurance costs the same regardless of your credit score

FHA mortgage insurance (MIP) requires an upfront premium of 1.75% of the loan amount. Additionally, you’ll pay an annual premium, which is typically going to be 0.55% per year divided by 12.

Conventional mortgage insurance is based on several factors, including your down payment amount, loan size, loan term, and credit score.

Here's a look at conventional PMI costs versus FHA mortgage insurance at various loan amounts and credit scores.

Debt-to-Income Ratio (DTI)

Your DTI represents the percentage of your monthly pretax income allocated to paying debts, such as your mortgage, student loans, auto loans, child support, and minimum credit card payments. A higher DTI indicates a greater likelihood of financial strain when managing your bills.

This is an area where FHA loans are generally easier to qualify for than conventional loans. They allow mortgage borrowers to have a DTI ratio of up to nearly 57% with an otherwise strong borrower profile.

For conventional loans, your DTI is typically limited to 43-50%.

Loan Limits

Your choice between an FHA and a conventional loan may depend on the price of the home you want to purchase.

The conforming loan limit for conventional loans, set annually by the Federal Housing Finance Agency, starts at $806,500 in 2025 and can reach $1,209,750 in high-cost housing markets. Loans exceeding these limits are classified as non-conforming jumbo loans, which have stricter qualification criteria.

Similarly, FHA loan limits are adjusted annually and vary by location and property type. In 2025, the FHA loan limit for a single-family home is $524,225 in most areas, rising to $1,209,750 in high-cost regions.

Appraisal Requirements

When obtaining a mortgage, your lender will almost always require a home appraisal. This assessment is necessary to confirm that the home's value justifies the loan.

In addition to assessing value, FHA loans require stricter appraisals to ensure adequate safety and habitability standards are met. For this reason, some homebuyers may choose a conventional loan if the property’s condition is questionable.

Note: In some circumstances, conventional loans may receive a “value acceptance”, which waives the need for an appraisal. This can be a great advantage for a conventional loan, as it shortens the loan process and eliminates the possibility of appraisal issues.

Property Use

When qualifying for a mortgage, lenders consider how buyers intend to use the property.

FHA loans require borrowers to use the home as their primary residence, making them unsuitable for property flipping or investment purposes. In contrast, conventional loans offer more flexibility, allowing buyers to purchase various property types, including primary residences, investment properties, and vacation homes.

Employment History

Employment history requirements are designed to ensure mortgage borrowers have a stable and reliable income to repay the mortgage. Conventional and FHA loans both require a history of steady employment.

Generally, lenders want to see a two-year work history as proof that your employment and income are stable. FHA employment requirements, however, are more flexible compared to conventional loan requirements. FHA loans, for example, may accommodate gaps in work history with an adequate explanation.

FHA’s employment history requirements are also more lenient for home buyers with non-linear career paths or recent job changes.

Lender Options

FHA loans are widely available through most banks, credit unions and lenders. However, some smaller lenders may focus more on conventional loans. Understanding whether you can get an FHA or conventional loan from the same lender can make comparing programs and rates much more straightforward.

Tip: When shopping for a mortgage, it helps to know if your lender specializes in the type of loan for which you’re applying. This will help you get the best service, rates and terms.

Down the Road: Refinance Options

Refinancing your mortgage can often help you save money.

When it comes to refinancing, FHA is the clear winner over conventional loans. This is because FHA mortgages allow for what’s known as “streamline” refinancing.

FHA streamlines allow mortgage borrowers to lower their interest rate or switch to a more favorable loan term with minimal documentation and requirements.

An FHA streamline refinance is a simplified refinancing option available to homeowners with an existing FHA loan, allowing borrowers to forego a credit check, income verification and even an appraisal.

Refinancing a conventional loan typically requires similar documentation to what you provided when you bought your home, i.e., credit check, paystubs, W-2s, home appraisal, etc.

How Sellers Perceive FHA vs. Conventional

An important consideration is the perception home sellers and their agents may have when presented with an offer using FHA financing vs. one with conventional financing. Sellers may view FHA loans less favorably due to stricter property standards and appraisal processes, potentially complicating transactions.

Conventional loans are generally perceived as a smoother and more efficient process by sellers when selling their home. Also, because conventional loans typically require a larger down payment, sellers often view this as a sign of having a better financial profile. This can give the seller confidence that there’s more likelihood their loan won’t be denied.

FHA vs. Conventional: Which Should You Choose?

The choice between FHA and conventional loans depends on your individual financial situation, credit profile, home loan needs, and homeownership goals. It’s important to compare the benefits and downsides of each loan type carefully.

FHA loans are ideal for buyers with lower credit or smaller down payments but come with higher costs due to mortgage insurance.

Conventional loans are better for buyers with strong credit and financial stability, offering long-term savings.

First-time buyers should consider their credit score, debt, and savings when choosing a loan.

FHA loans are more forgiving but may limit property options, while conventional loans provide greater flexibility.

When is an FHA Loan Your Best Bet?

An FHA loan is an excellent option if you’re eager to become a homeowner but face challenges with your financial profile or credit history.

FHA loans are particularly well-suited for individuals with a credit score that falls into the “fair” range and for those who cannot afford to save 10-20% of the home’s purchase price for a down payment. With a minimum down payment requirement as low as 3.5%, FHA loans can also make homeownership more attainable for buyers with limited savings.

For buyers seeking a straightforward path to owning a primary residence, particularly first-time buyers, the FHA loan offers a combination of affordability, flexibility, and accessibility that can help turn the dream of homeownership into a reality.

When Does a Conventional Loan Make the Most Sense?

Conventional loans are better for mortgage borrowers with a credit score in the good to excellent range, as it enables you to secure competitive interest rates and more favorable terms. Your monthly debt obligations should be below half of your income, demonstrating financial stability and the ability to manage the mortgage payment comfortably.

A significant advantage of a conventional loan is the ability to avoid private mortgage insurance (PMI) if you can make a down payment of at least 20%. This can lead to considerable savings over the life of the loan.

Conventional loans also offer more flexibility in property types, allowing you to purchase a second home, vacation property, or investment property.

If you meet the criteria, a conventional loan could provide you with greater long-term savings and broader opportunities for homeownership.

Which Loan is Better for First-Time Homebuyers?

For several reasons, FHA Loans are often well-suited for first-time buyers.

These loans are accessible to those with less-than-perfect credit or a higher debt-to-income (DTI) ratio, making them a popular choice for buyers who may face financial challenges. Additionally, thanks to the low-down payment requirement of just 3.5%, FHA loans are a great option for first-time buyers with limited savings.

In contrast, conventional loans may be a better choice for first-time buyers with stronger financial profiles, higher credit score and the ability to make a larger down payment (though it’s possible to make a down payment of just 3%).

While conventional loans generally have stricter underwriting requirements, they often come with benefits like lower interest rates for mortgage borrowers with higher credit scores, and no requirement for private mortgage insurance (PMI) if the down payment is 20% or more.

Ultimately, the best mortgage option for a first-time buyer will depend on balancing accessibility, affordability, and long-term costs based on your individual financial situation.

The Bottom Line: FHA vs. Conventional loans

While both of these loans can be a great option when buying a home, there are a few fundamental differences between conventional and FHA loans. And it’s important to remember that every mortgage program comes with benefits and drawbacks, which you’ll need to weigh before choosing between an FHA and a conventional loan.

A knowledgeable lender can help you compare conventional loans to FHA loans and help you decide which is better suited for you and your needs.