How to Refinance a Mortgage With Bad Credit

Homeowners with less-than-optimal credit still have options – including government-backed refinances with low credit requirements and some refinance loans that don't even require credit checks at all.

Refinancing your home can be a challenge for lower credit borrowers.

Most loan programs have minimum credit requirements, and not all lenders work with bad credit borrowers. Plus, a lower score usually means you'll pay a higher interest rate.

Thankfully, homeowners with less-than-optimal credit still have options – including government-backed refinances with low credit requirements and some refinance loans that don't even require credit checks at all.

Refinancing a Home With Bad Credit

Conventional loans – mortgages that meet the guidelines established by Fannie Mae and Freddie Mac – comprise the majority of home loans. However, conventional lenders require a minimum credit score of 620 in most situations.

Some borrowers may not qualify, and those who do might pay sky-high mortgage rates thanks to Fannie and Freddie risk-based pricing.

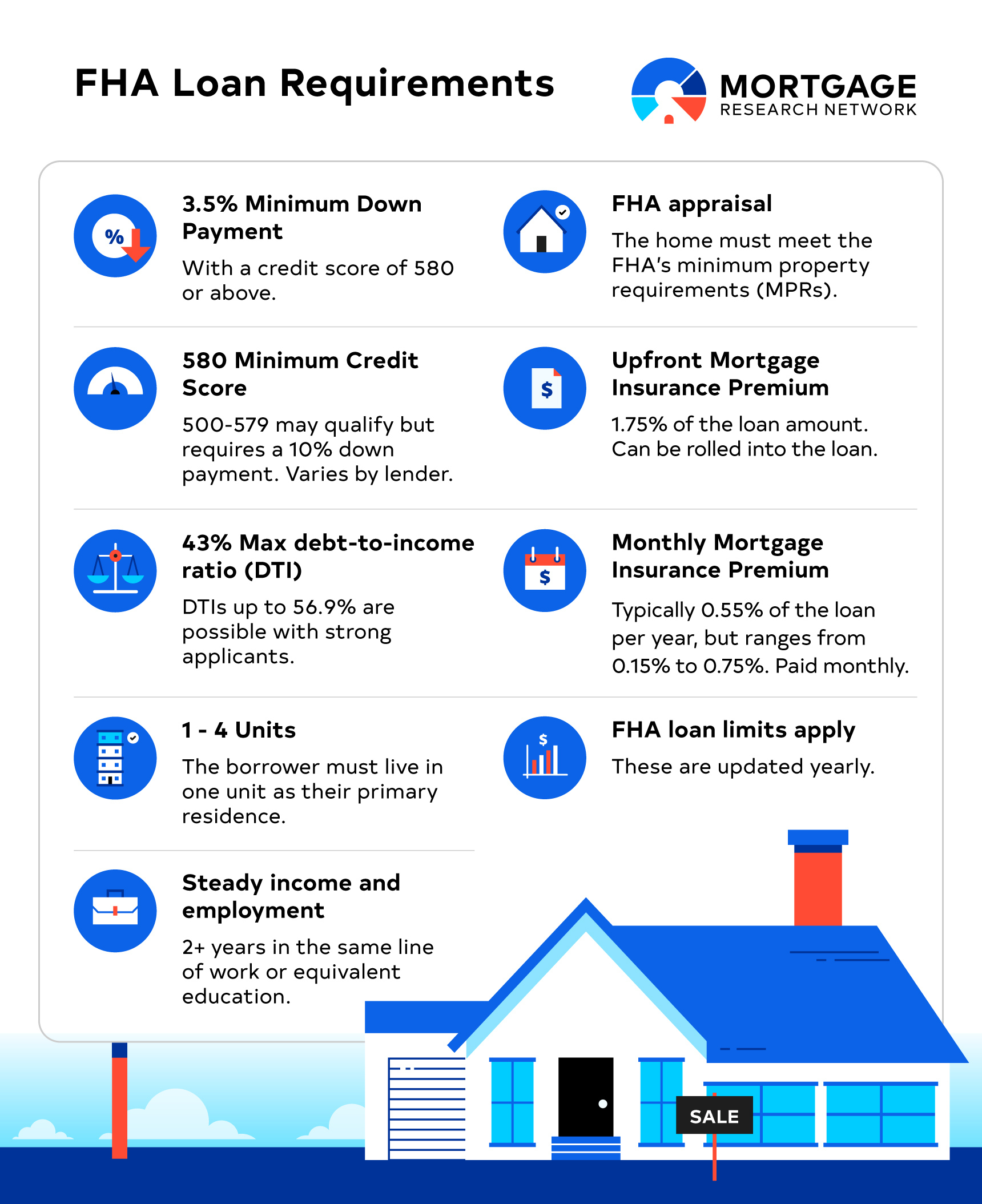

Most people turn to FHA-backed refi options available with a credit score as low as 500.

FHA Standard Refinance

If you currently have a conventional (or other non-FHA) loan, you can convert it into an FHA mortgage with an FHA standard rate-and-term refinance. This program allows you to reduce your interest rate and adjust the length of your loan.

If you've lived in your home for at least 12 months, you can refinance for up to 97.75% of the property's value assuming no cash-out. If it's been your primary residence for fewer than 12 months, you can refinance up to 85%.

FHA Streamline Refinance

Borrowers who currently have an FHA-backed loan can qualify for an FHA streamline refinance with less documentation, no required appraisal, and no credit check in most cases. Like the standard refinance, streamline loans allow you to drop your rate to what’s available in the market at the time.

You are eligible for an FHA streamline refinance anytime after making six mortgage payments, and at least 210 days have passed since closing on your current loan. However, your six most recent payments must have been on time, and you can only have one late mortgage payment within the past year.

You must also receive a net tangible benefit from refinancing. According to FHA guidelines, this means you have to either:

Reduce your rate (inluding any MIP reduction) by 0.5%

Convert an adjustable-rate mortgage that is past its initial fixed-rate period into a fixed-rate loan.

One downside of an FHA streamline refinance is that you cannot wrap closing costs into your loan. While the total may be marginally lower, thanks to the waived appraisal, you'll still need to have the funds available to close.

Some lenders may be willing to offer a "no closing cost" streamline refinance where they provide you with closing credits in exchange for a higher interest rate on your mortgage. The loan would still need to meet the net tangible benefit requirements in this scenario.

FHA Simple Refinance

Another program for homeowners with an FHA mortgage is the FHA simple refinance, which lets you qualify with less paperwork than a standard rate-and-term refinance. Unlike the streamline program, though, FHA simple refinances do require a credit check and appraisal.

The upside? Simple refinances allow you to wrap your closing costs into your mortgage to lower upfront expenses. This flexibility could make them a viable alternative for borrowers with bad credit who don't have the cash to close on a streamline refinance.

FHA Cash-Out Refinance

If you need to pull equity out of your home, an FHA cash-out refinance allows you to borrow up to 80% of your property's value. Like other FHA loans, borrowers are eligible for a cash-out refinance with a median credit score as low as 500.

You don’t need to currently have an FHA loan to qualify for a cash-out refinance. However, guidelines require that you have lived in your home as your primary residence for at least 12 months before closing on your refinance.

FHA 203(k) Refinance

If you're refinancing to cash out equity for home repairs or additions, consider an FHA 203(k) refinance. Because renovation refinance loans are calculated based on your home's estimated after-repair value, you can often access far more equity than a normal cash-out refinance.

Homeowners with a credit score of at least 580 can borrow up to 97.75% of their property’s future value to fund improvements. Borrowers with a score that's between 500 and 579 are eligible for FHA 203(k) refinance loans as high as 90%

Other Things to Know About Bad Credit FHA Refinances

FHA mortgages can be an excellent option for borrowers refinancing with less-than-perfect credit. There are, however, some other things you should be aware of:

FHA guidelines allow homeowners with a credit score as low as 500 to refinance. However, some lenders require a higher minimum, with 580 being typical. If your credit is between 500 and 579 and the mortgage company you're working with can’t approve you, shop around.

Non-streamline loans require that you have a debt-to-income ratio no higher than 50%. This means your monthly debt obligations, including your mortgage, can't total more than 50% of your qualifying income.

FHA loans are only available for your primary residence. If you need to refinance a second home or investment property, you’ll have to consider alternative loan options.

Unlike conventional loans, which only require mortgage insurance on refinances with less than 20% equity, all FHA loans require both an upfront mortgage insurance premium and monthly mortgage insurance payments.

The good news is that if you're refinancing to an FHA mortgage from another FHA loan you obtained within the past three years, you should be eligible for a refund of a portion of your upfront mortgage insurance premium.

Mortgage limits are typically lower for FHA loans than with conventional refinances.

Conventional Refinance Options With Bad Credit

If you have a credit score of at least 620 and a debt-to-income ratio of 45% or below, you may qualify for a conventional refinance. Property owners with at least 80% equity in their homes may benefit from not having to pay for mortgage insurance. However, conventional interest rates are generally the highest for borrowers with low credit.

HomeReady and Home Possible Refinances

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible refinance programs allow homeowners who earn no more than 80% of their area’s median income to refinance their home with reduced interest rates and lower insurance premiums.

RefiNow and Refi Possible Loans

If your current mortgage is owned or securitized by Fannie Mae or Freddie Mac, you may be eligible for a conventional refinance with no minimum credit score.

Fannie Mae’s RefiNow and Freddie Mac’s Refi Possible loan programs allow homeowners to refinance up to 97% LTV with no required minimum credit score and a debt-to-income ratio as high as 65%. Plus, both RefiNow and Refi Possible loans come with a $500 appraisal credit to help reduce closing costs.

To qualify for RefiNow or Refi Possible, you must:

Make no more than your area’s median income

Have had your existing loan for a minimum of 12 months

Not have made any late payments in the past six months and no more than one in the past year

Is for a one-unit primary residence

You can use the Fannie Mae loan lookup and Freddie Mac loan lookup tools to find out if your current mortgage qualifies for these programs.

Other Bad Credit Refinance Options

In addition to conventional and FHA-backed loans for borrowers with bad credit, here are some other options you may want to consider.

VA Interest Rate Reduction Refinance Loan (IRRRL)

If you currently have a mortgage through the Department of Veterans Affairs, you can reduce your interest rate and change your term with an Interest Rate Reduction Refinance Loan (IRRRL).

To qualify for a VA streamline loan, you must refinance to a lower rate or currently have an adjustable mortgage. Your new monthly principal and interest payments are also required to be lower unless you're:

Refinancing an adjustable-rate mortgage

Changing to a shorter term than your current loan

Wrapping energy-efficient improvements into your mortgage

The VA IRRRL is unique among bad credit refinance programs because it allows you to receive up to $6,000 back to reimburse for any energy-efficient improvements you've made within the 90 days prior to closing.

USDA Streamlined-Assist

Homeowners who currently have a loan backed by the USDA can apply for a USDA streamlined-assist refinance. This USDA program doesn't require a credit check, and you don't have to meet debt-to-income requirements.

You do, however, need at least 12 months of timely payments on your current loan and must be able to save a minimum of $50 per month by refinancing.

Non-QM Refinance Loans

Non-qualified mortgages (non-QM) are refinance loans that don't adhere to conventional or government-backed guidelines. Every non-QM lender sets their own requirements, and most of the time, you'll have little trouble finding bad credit refinance options.

However, you can expect non-qualified refinances to come with much higher interest rates than qualified loans.

A non-QM loan may be a good option for a cash-out refinance with bad credit if you have substantial equity in your home. Still, you'd likely do well to refinance again to a lower-rate loan once you've boosted your credit profile.

Negotiating With Your Current Lender

The easiest way to refinance your mortgage could simply be to talk with your current lender about refinancing options. In most cases, your lender would rather work with you to keep your business than have you refinance and pay off your loan altogether. Plus, if you plan to extend your mortgage for a longer period, working with you may be in their best interest.

If you’re currently behind on your monthly payments, your most practical option may be to talk with your current lender about loan modification. It can be tough to refinance with bad credit, but even more so if you’re delinquent on your existing mortgage.

Past-Due Accounts, Judgments, and Charge-Offs

If you have a court-ordered judgment against you, you'll need to pay that off to refinance with many types of loans. This includes both conventional and FHA refinances.

Plus, if you’re applying for a conventional mortgage, you’ll also need to bring any past-due accounts current. In some cases, with second homes and investment properties, accounts that have been charged off may also need to be paid.

Bankruptcy, Short Sale, Deed in Lieu, or Foreclosure

If your bad credit is the result of bankruptcy, foreclosure, short sale, or deed in lieu, there may be a waiting period before you can refinance your home. Waits depend on the type of loan you’re applying for and the type of derogatory mark on your credit.

Bankruptcy | Foreclosure | Short Sale or Deed in Lieu | |

Conventional | 2 to 4 Years | 7 Years | 4 Years |

FHA | 1 to 2 Years | 3 Years | 3 Years |

VA | 1 to 2 Years | 2 Years | 2 Years |

USDA | 1 to 3 Years | 3 Years | 3 Years |

Lenders may be willing to shorten the time you’re required to wait if you have documented extenuating circumstances that led to your derogatory mark. This could cut the waiting period by more than half in certain situations.

Refinancing Your Mortgage With Bad Credit

Finding a lender to refinance your home can be tricky if you have bad credit. Luckily, there are plenty of bad credit refinance programs out there. Some don’t even require a credit check.

To find the most practical refinance options for your individual situation, apply with an experienced lending professional who can guide you toward the best loans for bad credit borrowers.