How Much Does a Home Appraisal Cost in 2026?

The average home appraisal cost ranges from around $350 to $550 but can vary widely depending on home type, location, and more.

A home appraisal is a professional estimate of a property's market value. Nearly all types of residential mortgages require an appraisal. In some cases, current owners may choose to obtain one even if they aren’t planning to sell or refinance their home.

A properly licensed professional appraiser must complete appraisals. As such, you can expect to pay an appraisal fee ranging from a few hundred dollars to over $1,000 in some instances.

The average home appraisal cost ranges from around $350 to $550. However, numerous factors can impact this figure, and your actual cost may be higher depending on your individual appraisal needs.

Key Takeaways

Home appraisal costs vary by location and needs, but most buyers can expect a fee between $350 and $550.

Larger, remote, and unique homes may have higher-than-average appraisal costs.

Buyers and refinancing homeowners are typically responsible for the cost of a home appraisal, although it may be possible to negotiate for the seller or lender to pay the fee.

Government-backed mortgages have stricter requirements and generally have a higher home appraisal cost than conventional loans.

Factors Impacting Home Appraisal Cost

The cost of a home appraisal can vary from one property to the next. Numerous factors impact home appraisal costs, ranging from the location and size of the property to the type of mortgage you're applying for.

Location

Home appraisal costs are highly dependent on local market conditions. A hot housing market and shortage of appraisers can mean higher fees, while a slower market may mean less demand and lower costs.

Homes that are unique or in remote locations can also have higher-than-average costs because of the extra research and travel time required from the appraiser.

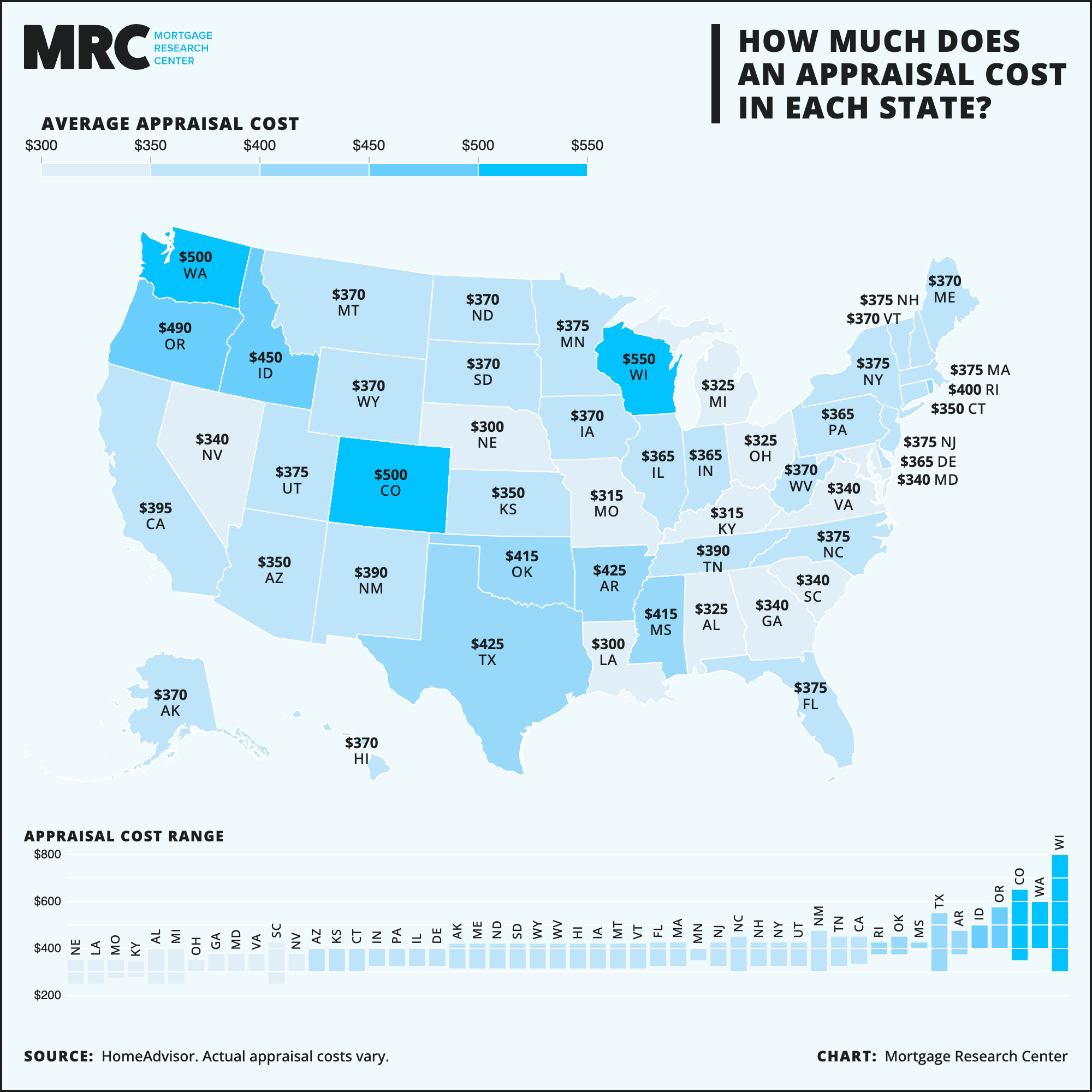

So, how much does a home appraisal cost in your area? Here is a compilation of the average cost of a home appraisal by state as reported by the Fixr and HomeAdvisor home services marketplaces.

State | Fixr | HomeAdvisor |

Alabama | $310 - $445 | $250 - $400 |

Alaska | $325 - $430 | $315 - $420 |

Arizona | $320 - $405 | $300 - $400 |

Arkansas | $360 - $455 | $375 - $475 |

California | $310 - $410 | $335 - $450 |

Colorado | $350 - $505 | $350 - $650 |

Connecticut | $310 - $385 | $300 - $400 |

Delaware | $330 - $395 | $325 - $400 |

Florida | $310 - $390 | $325 - $425 |

Georgia | $300 - $375 | $300 - $375 |

Hawaii | $325 - $430 | $315 - $420 |

Idaho | $395 - $530 | $400 - $500 |

Illinois | $325 - $415 | $325 - $400 |

Indiana | $335 - $415 | $325 - $400 |

Iowa | $325 - $420 | $315 - $420 |

Kansas | $325 - $405 | $300 - $400 |

Kentucky | $290 - $355 | $280 - $345 |

Louisiana | $405 - $460 | $350 - $250 |

Maine | $325 - $430 | $315 - $420 |

Maryland | $305 - $390 | $300 - $375 |

Massachusetts | $340 - $430 | $325 - $425 |

Michigan | $280 - $330 | $250 - $400 |

Minnesota | $350 - $460 | $350 - $400 |

Mississippi | $360 - $405 | $400 - $425 |

Missouri | $290 - $370 | $275 - $350 |

Montana | $325 - $430 | $315 - $420 |

Nebraska | $325 - $430 | $250 - $350 |

Nevada | $310 - $380 | $300 - $375 |

New Hampshire | $325 - $430 | $325 - $425 |

New Jersey | $385 - $595 | $325 - $425 |

New Mexico | $420 - $485 | $300 - $475 |

New York | $330 - $435 | $325 - $425 |

North Carolina | $295 - $390 | $300 - $450 |

North Dakota | $325 - $430 | $315 - $420 |

Ohio | $300 - $350 | $300 - $350 |

Oklahoma | $380 - $460 | $375 - $450 |

Oregon | $410 - $535 | $400 - $575 |

Pennsylvania | $330 - $395 | $325 - $400 |

Rhode Island | $380 - $435 | $375 - $425 |

South Carolina | $245 - $370 | $250 - $425 |

South Dakota | $325 - $430 | $315 - $420 |

Tennessee | $380 - $455 | $325 - $450 |

Texas | $340 - $445 | $300 - $550 |

Utah | $340 - $435 | $325 - $425 |

Vermont | $325 - $430 | $315 - $420 |

Virginia | $310 - $375 | $300 - $375 |

Washington | $410 - $590 | $400 - $600 |

West Virginia | $325 - $430 | $315 - $420 |

Wisconsin | $295 - $355 | $300 - $800 |

Wyoming | $325 - $430 | $315 - $420 |

Loan Type

Certain types of mortgages require a more in-depth appraisal than a typical conventional loan. If you're applying for a government-backed mortgage through the FHA, VA, or USDA, the cost of home appraisal services may be slightly higher.

The average FHA appraisal cost ranges from $400 to $700, according to HomeGuide.

USDA appraisal costs for guaranteed loans are similar to the FHA at around $400 to $700. The current fee for a USDA direct loan appraisal is $775.

VA appraisal costs start at $525 and run up to $1,300 in some high-cost areas, although fees in most parts of the country range from around $600 to $800.

Home Size

Larger homes can take more time and effort to appraise and thus may have a higher home appraisal cost. Similarly, home appraisals for multifamily properties with two-to-four individual units are more expensive than for a single-family home.

Property Condition

Properties in disrepair or otherwise poor condition can be more difficult to appraise. In most cases, the appraiser needs to put in more effort to find comparable properties for their calculations and may face more challenges in making accurate adjustments to compensate for the necessary repairs.

Who Pays for the Home Appraisal?

In a purchase transaction, the buyer is typically responsible for paying the home appraisal cost since it is generally considered part of the closing costs. However, the lender will likely require you to pay the fee when ordering the appraisal.

Keep in mind that in some situations – particularly in buyers’ markets or with hard-to-sell properties – it may be possible to negotiate seller concessions where the seller covers a portion of your closing expenses, including the home appraisal cost.

For refinances and other non-purchases, the homeowner is typically responsible for the cost of a home appraisal. If completed as part of a refinance, you may be able to negotiate lender credits to cover the appraisal fee in exchange for a marginally higher interest rate.

How Home Appraisals Work

Appraisals are scheduled by your lender when obtained as part of the mortgage process. To ensure an unbiased opinion of value, federal regulations restrict lenders from choosing specific appraisers to complete their appraisals. Instead, mortgage companies typically use an appraisal management company that matches requests with qualified local professionals.

As part of the appraisal, the appraiser generally conducts an in-person evaluation of the property, observing and noting features such as:

Square footage of the home and individual rooms

Number of bedrooms and bathrooms

Overall condition of the home

Functionality of electric, plumbing, and HVAC systems

Signs of pest infestations or related damage

Following their in-home assessment, the appraiser researches the value of similar nearby properties, both those recently sold and those currently listed for sale.

After identifying several comparable homes, the appraiser adjusts their values to compensate for any differences between them and the subject property. With these calculations complete, the appraiser can then establish an estimated value for the appraised home.

From here, the appraiser sends their completed appraisal report to the lender, who shares it with the borrower. If you're a buyer or existing owner refinancing your home, you get a copy of the appraisal. Sellers do not generally receive the appraisal report.

Note: With jumbo loans – mortgages for more than an area’s conventional loan limits – your lender may require you to obtain and pay for two separate home appraisals to provide a greater assurance of value.

What If the Home Doesn’t Appraise High Enough?

An under-appraisal can be a significant issue and potentially derail purchases and refinances since lenders base the amount they will loan on the professionally appraised value.

When a property appraises for less than expected, buyers may need to come up with a larger down payment to complete their purchase. At the same time, existing homeowners may need a cash-in refinance to cover their current mortgage.

FHA purchase agreements have an amendatory clause that allows the buyer to back out of the contract if the home appraises for less than the agreed-upon purchase price. VA loans also require a similar escape clause.

However, appraisal clauses can be added to any purchase contract, and financing clauses often exist that allow buyers to cancel the deal and receive their earnest money deposit back if they cannot obtain a mortgage.

Appraisals Benefit Buyers and Existing Homeowners

Most people associate getting an appraisal with purchasing a home. However, while there are many benefits of an appraisal for buyers, existing homeowners may also opt to have their properties appraised for various practical reasons.

Buyer Benefits

A few of the primary buyer benefits of a home appraisal include:

Ensure You Pay a Fair Price – A professional home appraisal provides peace of mind that you're not overpaying on your new property.

Uncover Major Issues With the Home – While a home appraisal is not an inspection, the appraiser looks for major issues or critical non-functional features.

Potential to Wrap Closing Costs Into Your Loan – If your new home appraises for more than the contract price, some lenders may allow you to wrap your closing costs into your new mortgage.

Homeowner Benefits

Current homeowners can also benefit from obtaining an appraisal to:

Help Set the Optimal Listing Price When Selling – Real estate agents can often suggest a reasonable listing price. Still, a home appraisal provides a more accurate idea of your property's value.

Eliminate Private Mortgage Insurance (PMI) – Conventional lenders require private mortgage insurance on all loans with less than 20% equity. If your home's value has increased to the point where you now have an 80% LTV or lower, a home appraisal can help you eliminate the monthly PMI requirement.

Appeal High Tax Assessments – If your home's taxable value is higher than it should be, you may be able to use a professional appraisal to appeal your assessment and potentially lower your property tax payments.

Home Appraisals vs. Home Inspections

There's a common misconception that a home appraisal is the same as a home inspection. While these services are similar, home appraisals and home inspections differ significantly.

A home appraisal's primary purpose is to determine the property's estimated value. Although the appraiser examines numerous aspects of the home, they primarily look for visual defects and obvious faults. They do not complete an in-depth inspection.

Conversely, a home inspection does not assign or establish value for a property. Instead, the inspector conducts an in-depth assessment of a home's features and mechanical systems, such as thoroughly testing plumbing and HVAC systems, noting any deficiencies, and providing an estimate of remaining life.

Nearly all mortgages require a home appraisal. But while it's helpful, you're generally not obligated to get a home inspection. When needed or requested by the buyer, the fee for an inspection will be in addition to the home appraisal cost.

How Long Is a Home Appraisal Good For?

The length of time a home appraisal remains good depends on your lender and the type of loan you’re applying for. In most cases, mortgage companies adhere to the following timeframes for accepting home appraisals:

Conventional lenders accept appraisals for up to one year, although they must be updated if more than four months old.

FHA lenders accept appraisals for up to 180 days. With an update, lenders can accept appraisals for up to one year.

VA appraisals are good for up to six months.

USDA appraisals are valid for up to 150 days but can be updated to a maximum of 240 days.

When You Need a Home Appraisal

You must have a home appraisal completed for most mortgage types. However, there are other times when you need a home appraisal. Some other common reasons for ordering an appraisal include:

Purchasing a home (some conventional loans may allow appraisal waivers)

Refinancing a home (streamline refinances do not require a new appraisal)

Cashing out home equity, whether through a cash-out refinance, home equity loan, or home equity line of credit (HELOC)

Setting a price before listing your home for sale

Dividing up assets during divorce or probate

Filing for bankruptcy

Pledging assets as loan collateral

What Home Appraisal Cost Should You Expect?

Ultimately, the cost of a home appraisal varies by your local market and individual appraisal needs. The good news is that your lender must provide you with a list of your estimated closing expenses – including the home appraisal costs – within three days of submitting your loan application.

For an accurate idea of how much home appraisals cost in your area, connect with a local lender who can review your personalized loan options and the expected costs.