Pros and Cons of FHA Loans vs. Conventional Loans

You may have heard that FHA mortgages are an excellent option for homebuyers with credit issues or sizable debts they're currently paying on. While both of these claims are true, they're only a couple of the many benefits of an FHA loan.

However, there are also some disadvantages of the FHA Loan that should be equally weighed before committing to a lender.

In this comprehensive guide, we'll discuss the pros and cons of an FHA loan, including how the government-backed program compares to conventional mortgage alternatives.

Key Takeaways

3.5% down FHA loans are available with a credit score of 580 or higher, and 10% down loans with a score of 500.

You can qualify for an FHA mortgage with a debt-to-income ratio as high as 56.9%.

FHA loans come with a 1.75% UFMIP and ongoing mortgage insurance premiums.

Well-qualified borrowers – with credit scores over 740 – may be better off going conventional.

What Is an FHA Loan vs. Conventional Loan?

An FHA loan is a type of residential mortgage backed by the Federal Housing Administration. Designed to provide affordable financing to buyers who may not be eligible through conventional lenders, the FHA program has approved over 40 million home loans since its inception.

Loans are issued by FHA-approved lenders and banks but insured against default by the federal government. This government backing allows providers to originate loans to a larger pool of applicants, often at interest rates lower than conventional alternatives.

Some of the ideal candidates for an FHA loan can include:

First-time homebuyers

Lower-income homebuyers

Buyers with lower credit scores

Buyers with less saved for a down payment

Buyers with significant derogatory credit events

Advantages of the FHA Loan

There's a good reason that the FHA loan program is one of the most popular mortgage options on the market: it's made homeownership possible for millions of Americans who otherwise would not qualify through traditional channels.

But what, exactly, are the most significant benefits of an FHA Loan?

Low Rates

As a rule of thumb, the interest rate on FHA-backed loans is typically lower than on a comparable conventional mortgage. This reduced rate stems from the fact that the United States government backs these loans, and so they pose less risk to lenders.

However, FHA mortgages won’t always be the lowest. In some scenarios, borrowers may be eligible for better rates elsewhere, depending on:

Credit score

Market interest rates

Qualifying income level

Down payment size

No Income Limit

Unlike other mortgage programs, FHA-insured loans do not have income limits for borrowers. This means there is no minimum required or maximum allowed income to obtain an FHA loan.

The lack of income limits for FHA loans contrasts with some conventional options, such as the Fannie Mae HomeReady and Freddie Mac Home Possible loans, which require borrowers to earn 80% or less of their area median income.

Similarly, the USDA loan program sets a maximum household income limit for all borrowers.

Keep in mind, however, that while you don't need a certain level of income to qualify for an FHA mortgage, you will need the earnings to support the size of the loan you're applying for.

Higher DTI Ratio

FHA lenders are able to approve borrowers with higher levels of debt than conventional alternatives allow. Based on current FHA guidelines, you can qualify for an agency-backed mortgage with a debt-to-income (DTI) ratio as high as 56.9%.

This metric measures how your debt obligations compare to your monthly qualifying income. A DTI of 56.9% means that your total monthly debts – including the mortgage you’re applying for – can make up nearly 57% of your earnings.

Conventional lenders, on the other hand, generally look for a DTI of 45% and under. However, borrowers with DTIs up to 50% may be approved if they have other compensating factors, such as an excellent credit score or a significant amount of cash in reserve.

Low Credit Score

One of the most helpful FHA loan benefits is that lenders can accept borrowers with lower credit scores than conventional mortgages.

While a credit score of at least 620 is required to qualify for a conventional loan (and even then, your rates will be high), borrowers with credit scores down to 580 can qualify for a 3.5% down mortgage through an FHA lender.

Program guidelines even allow borrowers with a credit score of 500 to qualify for a mortgage if they can come up with 10% down.

Lower Monthly Costs

For many borrowers, FHA loans come with lower monthly costs than a conventional mortgage. Here’s a scenario for a buyer with a 670 credit score who is approved for both FHA and conventional loans. If this were you, which option would you choose?

*All figures are estimates and will depend on your scenario. Not a quote or commitment to lend. Contact a lender for an accurate quote. Payment example based on $350k FHA loan at 6.6% rate and conventional loan at 7.016%, the average from Optimal Blue. Standard FHA mortgage insurance of 0.55% per year. Conventional mortgage insurance estimate of 1.54% per year from MGIC based on 670 credit score with 3% down.

While the above is based on a 670 credit score, buyers with higher scores may also save with the FHA. Even someone with a credit score of 720 may find rates and mortgage insurance more affordable by choosing the FHA. Use our FHA loan calculator to calculate your monthly mortgage payments with taxes and insurance.

Disadvantages of the FHA Loan

An FHA-backed mortgage can be a practical solution for homebuyers who can't qualify for a conforming mortgage or who do qualify but at unaffordable rates.

However, that's not to say that the FHA program is right for everyone. There are some disadvantages of an FHA loan to take into account when comparing your different mortgage options.

Higher Down Payment

While most conventional loans require a minimum of 5% down, several programs – particularly for first-time and lower-income homebuyers – allow you to purchase with just a 3% down payment.

Comparatively, borrowers with a score of 580 need 3.5% down for an FHA loan. Those with a score of 500 – 579 are required to have 10%.

Here's a quick chart showing what kind of down payment would be required with each program at various home prices.

FHA 3.5% Down | FHA 10% Down | Conventional 3% Down | Conventional 5% Down | |

$200,000 | $7,000 | $20,000 | $6,000 | $10,000 |

$250,000 | $8,750 | $25,000 | $7,500 | $12,500 |

$300,000 | $10,500 | $30,000 | $9,000 | $15,000 |

$350,000 | $12,250 | $35,000 | $10,500 | $17,500 |

$400,000 | $14,000 | $40,000 | $12,000 | $20,000 |

$450,000 | $15,750 | $45,000 | $13,500 | $22,500 |

$500,000 | $17,500 | $50,000 | $15,000 | $25,000 |

Lower Loan Limits

One con of an FHA loan is that the maximum loan limit is lower than a conventional mortgage in most cases.

The Department of Housing and Urban Development (HUD) establishes annual loan limits for FHA-backed mortgages. For most areas of the country, these maximums are locked at 65% of conventional limits.

This equates to a 2025 FHA limit of just under $524,225 for single-family homes in most communities. However, the limit is higher for two, three, and four-unit properties.

One Unit | $524,225 |

Two Unit | $671,200 |

Three Unit | $811,275 |

Four Unit | $1,008,300 |

Alternatively, the current conventional loan limit for a single-family residence in most of the United States is $806,500, and it goes up to nearly $1.5 million for a four-unit property.

Keep in mind that certain designated high-cost areas have expanded loan limits that are the same for conventional and FHA-backed mortgages. In some parts of the continental US, high-cost loan limits for single-family properties can be as much as $1,209,750.

Upfront Fees

All FHA loans have an upfront fee – due at closing – referred to as the upfront mortgage insurance premium (UFMIP). The FHA UFMIP is currently set at 1.75% of your total loan balance.

Loan Amount | 1.75% UFMIP |

$200,000 | $3,500 |

$250,000 | $4,375 |

$300,000 | $5,250 |

$350,000 | $6,125 |

$400,000 | $7,000 |

$450,000 | $7,875 |

$500,000 | $8,750 |

As you can see, the FHA upfront fee can significantly add to a buyer's closing costs. Thankfully, FHA guidelines allow you to wrap the UFMIP into your loan balance. However, doing so means paying extra interest on the rolled-in fee.

Permanent Mortgage Insurance Premiums

In addition to UFMIP, FHA loans include ongoing mortgage insurance premiums in your monthly payments. For most buyers, this is at an annual rate of 0.55% of your loan amount, divided evenly among your payments.

While conventional loans with 3% and 5% down also require private mortgage insurance, homeowners can eliminate their PMI payments once they reach 20% equity. In most cases, FHA mortgage insurance premiums continue for the life of the loan, no matter the amount of built-up equity.

Stricter Property Conditions

Regardless of the type of mortgage you apply for, you need to order an appraisal. The appraisal establishes a valuation for the property and reassures lenders that they aren't letting you borrow more than the home is worth.

When it comes to FHA loans, however, the appraiser also conducts a basic assessment of the home to ensure that it meets the Federal Housing Administration’s minimum property requirements (MPRs).

Some of the things the inspector checks for include:

Structural soundness

Access to utilities

External nuisances, such as high-traffic roads

Leak-free roofing

Damage from termites or other organisms

HVAC system’s functionality

Conventional lenders still want to ensure that the property you're purchasing is in reasonable condition – you probably won't get a loan for a home with a collapsed roof and cracked foundation – but overall, property requirements are less strict than with an FHA-backed mortgage.

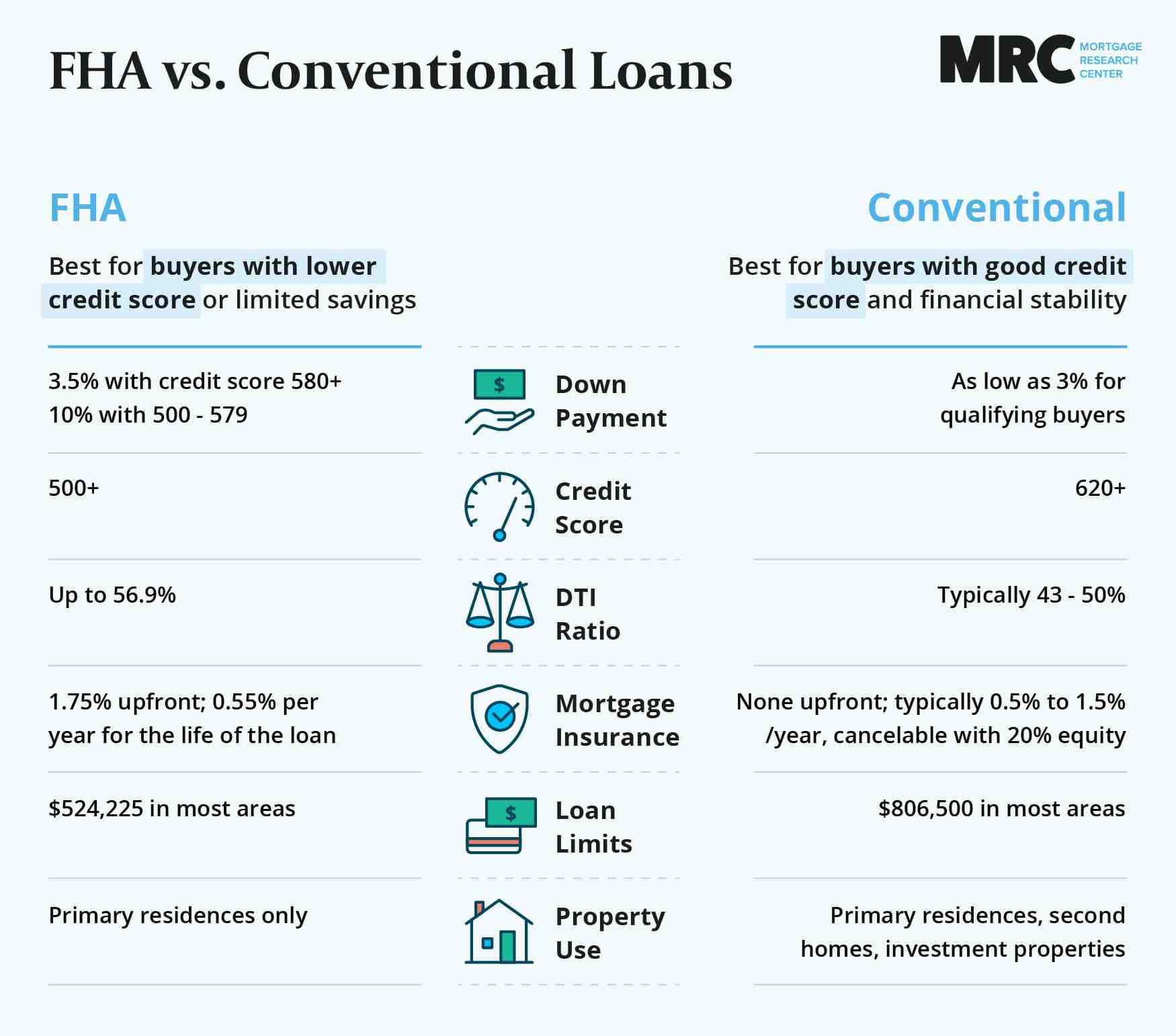

FHA vs. Conventional Loan Comparison

Still wondering exactly how an FHA loan stacks up against its conventional mortgage alternative? Here's a convenient FHA vs. conventional loan comparison chart that breaks down all the biggest differences between the two programs.

Loan Feature | FHA | Conventional |

Down Payment | 3.5% | 3% |

Credit Score | 580 (500 with 10% down) | 620 |

Debt-to-Income Ratio | Up to 56.9% | 45% to 50% |

Mortgage Rates | Much lower for credit scores <740 | High for lower-credit borrowers |

First-Time Buyers Only? | No | Some programs |

Upfront Mortgage Insurance | 1.75% of loan | N/a |

Monthly Mortgage Insurance | $46/month per $100k borrowed | $25 to $200+/month per $100k borrowed depending on credit & down payment |

Is Mortgage Insurance Cancellable Without Refinancing? | No | Yes |

Loan Limits | $524,225 in most areas | $806,500 in most areas |

Income Limits | None | 80% of area median for some 3% down programs |

Property Requirements | Slightly stricter than conventional | Looser than FHA |

2-4 Units | Allowed | Allowed with 5% down |

Occupancy | Must live in the home | Investment properties allowed with 15%+ down |

Bottom Line: Make Sure to Compare Your Options

For many buyers – especially those with credit scores below 740 – an FHA loan may offer lower monthly payments than a conventional conforming loan. However, these savings aren't set in stone; in some scenarios, a conventional mortgage may make more sense, even for lower-credit buyers.

Before committing to an FHA loan, check out current mortgage rates and apply with a reputable lender who can compare your options and help you determine which mortgage type best suits your unique borrowing needs.