FHA Loan Down Payment Requirements

The current FHA down payment requirement is 3.5% for buyers with credit scores of 580 and higher, 10% for those with a score of 500-579.

Saving up a large enough down payment is one of the biggest obstacles to homeownership for many prospective buyers. Thankfully, some mortgage options like FHA allow borrowers to purchase a home with a relatively small amount down. These loans are insured by the Federal Housing Administration (FHA).

FHA loan down payments can be as low as 3.5% of the home’s purchase price, making buying a home far more affordable for the average buyer.

Key Takeaways

Borrowers with a credit score of 580+ are eligible for a 3.5%-down FHA loan.

Borrowers with credit scores between 500 and 579 are eligible for a 10%-down FHA loan.

Conventional down payment requirements range from 3% to 5%, although qualifying can be more difficult.

FHA loan down payment assistance programs and other cost-reducing strategies can lower the amount of cash needed to close.

FHA Minimum Down Payment Requirements

The minimum down payment required for an FHA loan depends on your credit score. Borrowers with a score of 580 or higher are eligible for an FHA mortgage with just 3.5% down.

Applicants with scores between 500 and 570 can still qualify for an FHA loan, but they must make a down payment of at least 10%.

Borrower’s Credit Score | FHA Loan Down Payment Percentage |

580+ | 3.5% |

500-579 | 10% |

Here’s a chart comparing how each of these FHA loan down payment percentages translate into the cash you’ll need to purchase a home at varying prices.

FHA Loan Down Payment Examples

| Purchase Price | 3.5%-Down FHA Loan | 10%-Down FHA Loan |

|---|---|---|

| $150,000 | $5,250 | $15,000 |

| $200,000 | $7,000 | $20,000 |

| $250,000 | $8,750 | $25,000 |

| $300,000 | $10,500 | $30,000 |

| $350,000 | $12,250 | $35,000 |

| $400,000 | $14,000 | $40,000 |

| $450,000 | $15,750 | $45,000 |

| $500,000 | $17,500 | $50,000 |

Down Payment: FHA vs. Conventional Loans

FHA-backed mortgages are just some of the low-down payment options out there. In fact, some conventional programs let qualified applicants buy a home with as little as 3% down.

However, these mortgages typically have more restrictions than an FHA loan, and getting approved can be more difficult for some buyers. Borrowers who are not eligible for a 3%-down conventional loan program must put a minimum of 5% down.

First-Time Homebuyer Requirement: Some 3%-down conventional programs require you to be a first-time homebuyer. This means that you must not have owned residential property within the past three years. Current and recent homeowners do not qualify.

Income Limits: Other conventional loans, such as the Fannie Mae HomeReady and Freddie Mac Home Possible programs, require you to earn 80% or less of your area’s median income. Average-or-higher earning applicants do not qualify.

Credit Score & Debt-to-Income Ratios: You generally need a higher credit score and lower debt-to-income (DTI) ratio to qualify for a 3% down conventional loan. Conventional lenders require a credit score of 620 or higher and have maximum DTI limits of 45% to 50%.

However, FHA loans have more lenient guidelines, such as:

No first-time homebuyer requirement

No income limits

Mortgage insurance is more affordable for lower-score borrowers

Buyers often find that even though the minimum down payment for an FHA loan is 0.5% higher than a 3% conventional mortgage, the easier qualification and cheaper mortgage insurance are worth saving up the slightly larger down payment amount. Plus, once you reach 20% equity in your home, you can always refinance out of an FHA loan and into a conventional mortgage to eliminate annual FHA mortgage insurance premiums.

What About Other Mortgage Options?

Looking for other options? Here are the down payment requirements for some alternatives to both FHA and conventional mortgages.

USDA Down Payment Requirements: Buyers purchasing property in a rural or eligible suburban area may qualify for a 0%-down USDA loan at a very competitive interest rate. However, USDA home loans have income restrictions, and many lenders look for a credit score of 640 or higher.

VA Down Payment Requirements: Borrowers who qualify for a Certificate of Eligibility from the Department of Veterans Affairs (VA) may be able to purchase with 0% down and no required mortgage insurance or ongoing annual fees with a VA loan. Credit score requirements vary by lender.

State/Local Program Down Payment Requirements: Many state, county, and local government agencies offer down payment assistance programs that can reduce the amount you need to close.

For example, the Florida Assist program reduces your down payment by up to $10,000. Similarly, the Los Angeles Housing Department's LIPA program offers qualifying applicants as much as $161,000.

Are There Any FHA Loan No-Down Payment Options?

Technically, the FHA does not offer any zero-down payment mortgage options. Most qualifying borrowers need to put down 3.5% of their home's purchase price, and applicants with credit scores between 500 and 579 need 10%.

However, there are some ways to get an FHA loan with no down payment, such as combining down payment assistance with an FHA loan to reduce the cash needed to close.

Strategies for Covering Your FHA Loan Down Payment

Having trouble putting money aside for your FHA loan down payment or simply need to purchase now and don’t have the time to save? Here are some other strategies for covering your down payment.

Gift Funds

The FHA allows you to receive gift funds from a variety of sources, including:

Family members

Close friends

Employers and labor unions

Charities

Government agencies

There’s no limit to the amount of gift funds you can receive with an FHA loan.

Eligible gifts can go toward your minimum down payment and closing costs, and can even be used to make a larger-than-required down payment to reduce the amount you need to borrow.

Down Payment Assistance

FHA loan down payment assistance is not offered by the FHA itself, but rather through local government agencies and nonprofit organizations throughout the country. In many cases, FHA down payment assistance takes the form of a grant or silent second mortgage, which may:

Not require repayment

Be forgiven after a certain number of years

Come due only when you sell the home or refinance your loan

Seller Concessions

The FHA allows buyers to receive seller concessions for up to 6% of a property’s purchase price. While you cannot technically use seller concessions for your down payment, they can be put towards your closing costs and escrow accounts, allowing you to re-allocate the funds you saved for those expenses toward your required down payment.

401(k) Loan

If you have a large enough vested balance in your 401(k) retirement plan, you may be eligible to borrow against it and use the funds for your down payment without any tax penalties. Keep in mind that you'll need to repay this loan on top of your new mortgage payment, which could put additional pressure on your monthly budget.

Cryptocurrency

If you can document 60 days of cryptocurrency ownership and have converted it to U.S. dollars, you can use crypto proceeds to fund your down payment.

Other FHA Loan Costs to Consider

It often surprises prospective homebuyers that their down payment is not the only cash they need to bring to closing.

FHA Upfront and Annual Mortgage Insurance Premiums: All FHA-backed loans have two forms of mortgage insurance premiums: an upfront mortgage insurance premium (UFMIP) and an annual MIP.

FHA UFMIP is 1.75% of the loan amount and is paid at closing or wrapped into your new loan balance. Your UFMIP is separate from the ongoing annual mortgage insurance premium of around 0.5% for most FHA borrowers.

Conventional loans do not have an upfront mortgage insurance charge, and ongoing private mortgage insurance costs are based on the borrower's credit score and down payment size.

FHA Closing Costs: Apart from the UFMIP, you must cover other purchase-related closing expenses such as origination fees, appraisal costs, and lender discount points. You can expect your total FHA closing costs to run between 3% and 6% of your loan balance.

Closing costs are generally similar for conventional mortgages, although appraisal fees are typically slightly higher for FHA loans. Conventional closing costs usually run between 2% and 4% of your loan balance since you aren't paying for the FHA's 1.75% UFMIP.

Our Take: If You’re Considering a Conventional 3% Down, Try for 5% Instead

Conventional loans can be restrictive and cost more when putting just 3% down. If you can swing it, aim for 5% down instead.

There are no income limits or first-time buyer requirements with a 5% down payment. Additionally, your monthly mortgage costs will likely drop.

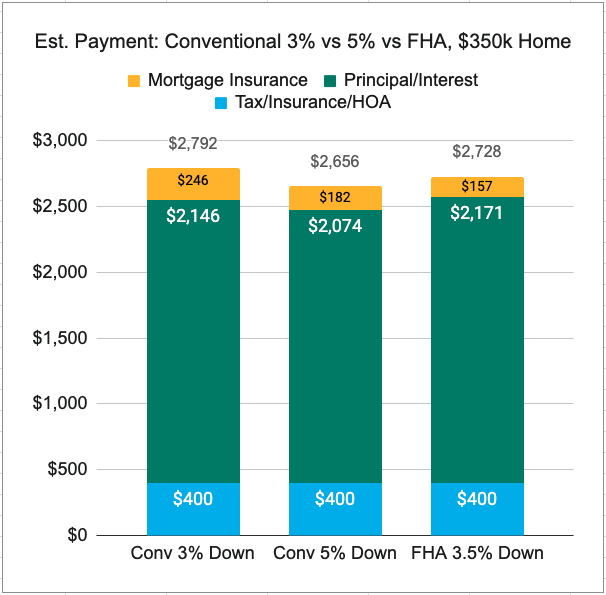

Here’s an example comparison for someone with a credit score of 720 buying a $350,000 home.

All figures are for example purposes only. Your costs will be different.

| Expense | Conventional 3% Down | Conventional 5% Down | FHA 3.5% Down |

|---|---|---|---|

| Principal & Interest Payments | $2,146 | $2,074 | $2,171 |

| Mortgage Insurance | $246 | $182 | $157 |

| Tax/Insurance/HOA | $400 | $400 | $400 |

| Total Payment: | $2,792 | $2,656 | $2,728 |

Mortgage insurance rates from MGIC. Example rates: Conventional 3% down at 6.5% and conventional 5% down at 6.375%. FHA loan at 6.5%. All 30-year fixed with standard mortgage insurance for the program. All figures are for example purposes only and may not be available.

Keep in mind that this is just one example scenario. Numerous factors impact your monthly costs, and your individual calculations will likely differ. When applying for a home loan, always compare FHA and conventional loan costs side-by-side. You can use our FHA mortgage calculator and conventional loan calculator to estimate your monthly payments with each loan type, with both taxes and insurance included.

Down Payments: Low for Both Programs

Both conventional and FHA loan down payment requirements remain reasonable for most potential homebuyers, with down payment options ranging from 3% to 5%. Plus, obtaining down payment assistance can further reduce the amount you need to bring to closing.

Ultimately, the best mortgage option depends on your financial profile and unique borrowing needs. To compare low-down-payment FHA and conventional mortgage options, check out today's interest rates and apply with a lender in your community.