Conventional Loan Requirements in 2025

Homebuyers often share a similar preconception about conventional loans: they’re tough to qualify for if you don’t have perfect credit and a large down payment.

But meeting conventional loan requirements is likely more straightforward than you think. In fact, most residential mortgages are issued by conventional lenders.

This article will cover everything you need to know about how to qualify for a conventional loan, including the necessary credit score, down payment, and other lender minimums.

Key Takeaways

The majority of residential mortgages are conventional, meaning many buyers meet conventional loan requirements.

Standard requirements for a conventional loan include a 620 credit score, a 5% down payment, and a debt-to-income ratio of 45-50% or less.

Some conventional loan programs targeted at first-time and low-to-moderate income homebuyers allow eligible applicants to buy with a reduced 3% down payment.

Lenders prefer to see at least two years of employment and income history, although it may be possible to get approved with less – even if you’re self-employed.

In some scenarios, borrowers who qualify for a conventional loan may still be able to find lower rates through government-backed alternatives.

What Is a Conventional Loan?

Conventional loans are mortgages not insured by government agencies. Loan types that are not classified as conventional are FHA, VA, or USDA loans. In most cases, conventional mortgages will be conforming, meaning that they “conform” to guidelines established by Fannie Mae and Freddie Mac.

Although not all conventional mortgages are conforming, the term conventional is widely used to signify a conforming loan, even among professionals within the mortgage industry.

Who’s a Good Candidate for a Conventional Loan?

Prospective homebuyers – particularly those purchasing for the first time – often think getting a conventional loan is difficult. While lending standards may be stricter than with some government-backed programs, most homebuyers will still meet conventional loan requirements.

The reality is that conventional loans can be ideal for many different types of buyers, even if they think their:

Credit score is too low

Debt level is too high

Down payment is too small

Property won’t meet lender requirements

Lower-income borrowers

Here’s something few people know about. First-time buyers who make their area’s median income or less qualify for lower rates than other buyers. Or, you can make up to 120% of your area median income in high-cost areas. Check with your lender on whether you qualify for this incentive.

Why use a Conventional Loan?

There are a few reasons people like conventional loans.

- It’s easier to get an accepted offer. Sellers often reject FHA offers because they view them as not as strong. That’s typically not the case, but that’s most seller’s perception.

- You can cancel mortgage insurance when you reach about 20% equity in the home. So when you pay down the loan or the home’s value rises enough, you can remove mortgage insurance. FHA loans have lifetime mortgage insurance.

There are other reasons, but these are the two key advantages to using a conventional loan.

Conventional Loan Requirements

Unsure if you are able to qualify for a mortgage? Here is a breakdown of the different conventional loan requirements lenders will be looking for and the standards you’ll need to meet to get approved.

Credit Score

You'll need a minimum credit score of at least 620 to qualify for a conventional loan. However, some lenders may have higher requirements. In many cases, borrowers with moderate credit who are eligible for a conventional loan may still find better rates elsewhere. For applicants with a score below 720, monthly payments often remain lower with FHA-backed mortgages.

Foreclosure, Bankruptcy, and Short Sale

If your credit report shows a recent foreclosure, bankruptcy, or short sale, you may face a waiting period to get a conventional loan – even if your credit score meets lender minimums.

Credit Event | Waiting Period |

Foreclosure | 7 Years |

Bankruptcy | 2 to 4 Years |

Short Sale | 4 Years |

However, if your adverse credit event resulted from extenuating circumstances beyond your control, you may be eligible sooner.

Credit Event | Waiting Period (Extenuating Circumstances) |

Foreclosure | 3 Years |

Bankruptcy | 2 Years |

Short Sale | 2 Years |

What, exactly, do lenders consider to be extenuating circumstances? Some of the most commonly accepted reasons include:

Loss of employment

Reduced income from the death of a spouse

Divorce

Sizable medical debt

Charge-Offs, Collections, and Late Payments

In most cases, having charge-offs, collections, or late payments on your credit report will not prevent you from meeting conventional loan requirements. The main exception is if you have had a past-due mortgage payment within the past 12 months.

However, sometimes, you may need to pay off some or all of these debts to qualify with a conventional lender. This typically applies to late payments that have not yet been written off, but in some scenarios – namely with second homes and investment properties – charge-offs and accounts in collections may also need to be paid.

Borrowers Without Credit Scores

Applicants who do not have enough credit history to generate accurate scores with the three major credit agencies may still qualify for a conventional loan through non-traditional credit.

Some of the most common types of accounts used to establish a non-traditional credit history can include:

Rental payments

Utility bills

Auto loans

Insurance premiums

Cellphone plans

Debt-to-Income (DTI) Ratio

Lenders use a borrower's debt-to-income (DTI) ratio to help determine whether they can afford the mortgage they're applying for.

DTI is calculated by adding up your total monthly installment debts – including your prospective mortgage – and dividing that sum by your monthly gross income. In most cases, conventional lenders will look for a DTI between 43% and 45%. However, ratios as high as 50% may be accepted in some circumstances.

For Example: You have a gross monthly income of $7,000 and are applying for a mortgage with a monthly payment of $1,800. You currently have an auto loan for $600 per month, credit card minimums of $300, and student loan payments of $300.

In this scenario, your DTI would be just under 43% ($3,000 monthly debt / $7,000 monthly income), meeting the conventional loan requirements for most lenders.

Employment and Income

Lenders generally expect borrowers to have at least two years of steady employment and income history. This doesn't need to be with the same employer but should be in a similar role or position with stable or increasing income.

Some of the income and employment documents you’ll need to provide include:

Pay stubs

W-2 forms

Filed and accepted federal tax returns

Proof of court-ordered payments such as alimony or child support if applicable

In certain circumstances, lenders may be able to approve your application even if you don’t have two full years of employment history. This can include if you have a recent employment gap of six months or fewer.

Self-Employment

Self-employed borrowers are often required to provide extra documents relating to their business and personal finances. Lenders typically want two full calendar years of income statements and tax returns. In practice, self-employed borrowers often need more than two years in business to ensure two full years of documentation.

In some cases, however, lenders working with Fannie Mae can approve self-employed borrowers with just one full year of business income so long as the applicant transitioned into self-employment from a related position in the same field.

Down Payment

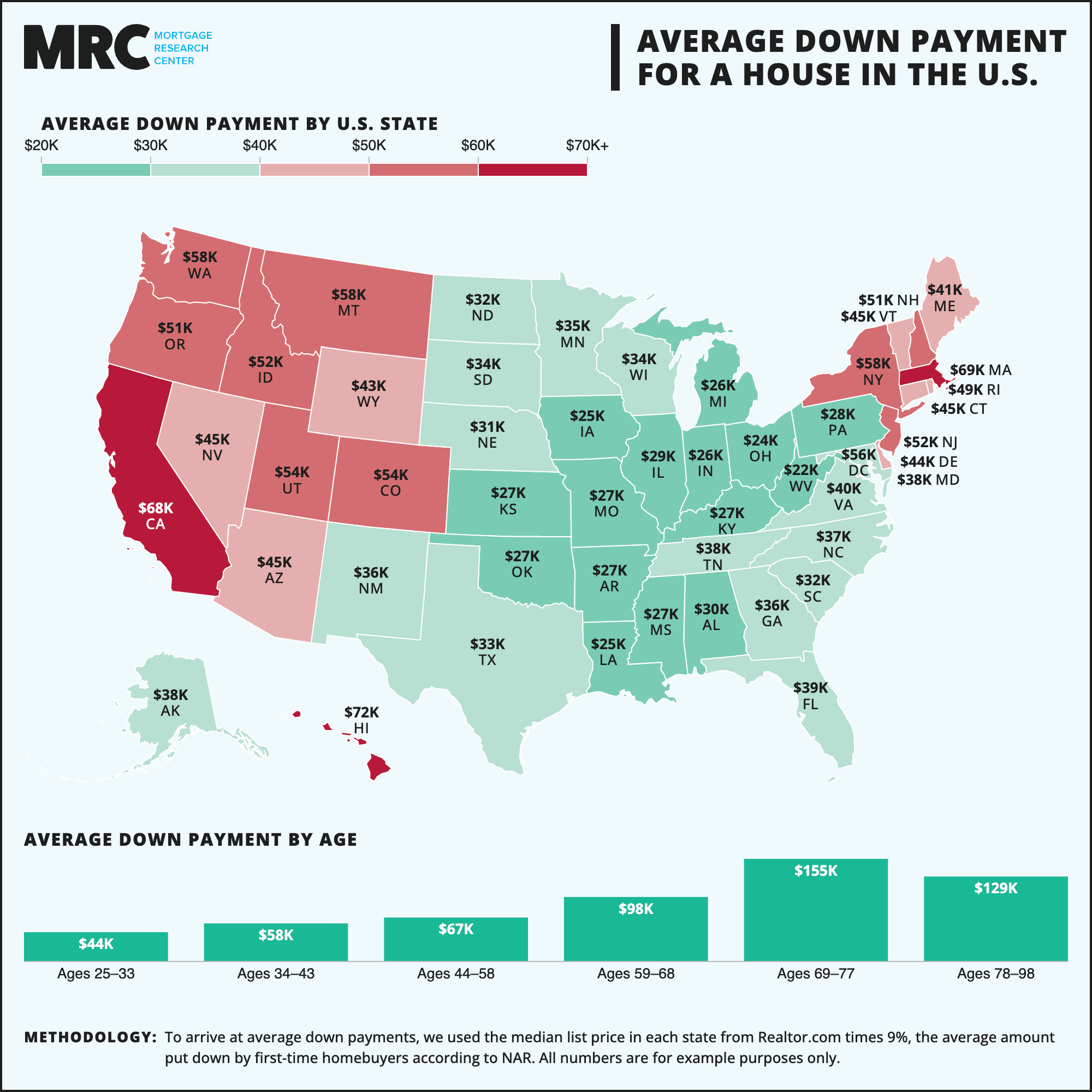

There's a common misconception that you must put 20% down to be eligible for a conventional loan. While this may have been true in decades past, most conventional borrowers can qualify with as little as 5% down. In some cases, particularly for first-time and lower-income homebuyers, you may be able to meet conventional loan requirements with just 3%.

Learn more about the average down payment on a house here.

Down Payment Assistance

You can apply for down payment assistance to cover some or all of the required upfront amount.

Down payment assistance programs vary by locale and are generally offered through government agencies, non-profits, employers, and individual lenders.

Private Mortgage Insurance

While it's possible to qualify for a conventional loan with 3% down, applicants with less than 20% will be required to pay for private mortgage insurance (PMI). This protects the lender from loss if the borrower stops making their payments.

Conventional PMI costs more for borrowers with lower credit scores. While every situation is different, applicants with credit scores of around 720 or lower may find conventional PMI costs higher than the mortgage insurance premiums charged on FHA loans.

However, the advantage of conventional PMI is that you can cancel it when you reach about 20% equity in the home. So if you build equity by paying down the loan or increasing the home's value, or both, you may be able to eliminate this monthly cost.

Closing Costs

Closing costs are the expenses associated with purchasing property and taking out a mortgage. While this isn't a conventional loan requirement, per se, borrowers are expected to have the funds on hand to cover their costs at closing.

This amount will be in addition to your required down payment and typically runs between 2% and 4% of the loan amount for most conventional homebuyers.

Seller Contributions

Conventional lenders allow sellers and other parties with a financial interest in the transaction (such as builders, developers, and real estate agents) to contribute funds to cover your closing costs. The amount allowed varies based on the size of your down payment:

Down Payment | Max. Seller Contributions |

< 10% | 3% |

10% to 24.99% | 6% |

25%+ | 9% |

These limitations apply to both primary residences and second homes. Investment properties, regardless of down payment, have a maximum seller contribution of 2%.

Check out our guide to buying an investment property with a conventional loan to learn more.

Closing Cost Assistance

Most down payment assistance programs can also be applied to your closing expenses to serve as closing cost assistance. While specifics will vary by program, you may be able to qualify for a grant or forgivable loan to pay some or all of your closing costs.

Loan Limits

Conventional loans cannot exceed the loan limits set annually by the Federal Housing Finance Agency. These limits can vary based on the area you’re purchasing and the number of residences on the property.

The single-unit limit is currently $806,500 for most parts of the United States. However, some high-cost communities and homes with more than one unit will have higher limits. You can check your area's loan limits with Fannie Mae’s lookup tool.

Units | Standard Limits 2025 | High-Cost Limits 2025 |

1 | $806,500 | $1,209,750 |

2 | $1,032,650 | $1,548,975 |

3 | $1,248,150 | $1,872,225 |

4 | $1,551,250 | $2,326,875 |

Cash Reserves

Cash reserves are sometimes required to ensure that borrowers have the funds available to make their mortgage payments after closing. Most homebuyers purchasing a single-family primary residence will not need any cash reserves if they qualify under automated underwriting.

In some cases, however, borrowers qualifying through manual underwriting may be required to have two or six months of PITIA payments in reserve, depending on their credit score, DTI, and down payment.

Property Requirements

Property requirements for conventional loans are generally less restrictive than government-backed programs offered through the FHA, VA, or USDA. To qualify with a conventional lender, the property you're purchasing must be:

Residential in nature

Safe, sound, and secure

Have no more than four individual units

Be accessible by road

Be serviced by utilities as per local standards

Appraisal Requirements

Conventional lenders require a property appraisal for nearly all loans. This professional estimation of value helps to ensure that the borrower isn't overpaying for their home. If the property you're purchasing appraises for less than your purchase price, you may be required to put down a larger down payment to qualify for funding.

The appraisal also verifies that the home is structurally sound. Conventional lenders will not lend on homes with significant problems, such as major roof issues or defects in the foundation. However, conventional appraisal requirements tend to be more relaxed than with FHA, VA, and USDA-backed alternatives.

Homes that don't meet requirements may be eligible for a conventional renovation loan to bring it up to standards.

There are some scenarios where an appraisal may not be required. Appraisal waivers are issued by the automated underwriting systems used by lenders and are impossible to predict. However, some factors that may lead to an appraisal waiver include:

A large down payment

An exceptional credit score

Considerable other assets

Another appraisal was recently obtained for the property

Co-signers and Non-Occupant Co-Borrowers

A co-signer or non-occupant co-borrower can help you qualify for a conventional mortgage when you don't have enough income – or have too many other debts – to get approved on your own. For the most part, 5% down conventional loan requirements allow for co-signors and co-borrowers. However, some individual programs, such as Freddie Mac HomeOne, may have their own restrictions.

If you plan to use a co-signor or non-occupant co-borrower to obtain a conventional loan, you will need a minimum 5% down payment.

Gift Funds

There is generally no limit on the amount of gift funds you can receive from someone with a close relation, such as a parent, sibling, or child. You can also receive funds from your partner and their relatives. Additionally, conventional loan requirements allow you to use gift funds from a recent wedding or graduation.

If you’re purchasing a primary residence or second home, gift funds can be applied to some or all of your:

Down payment

Closing costs

Required reserves

Conventional Loan Variations for Added Flexibility

Conventional loans are not "one size fits all." Lenders offer a variety of conventional programs designed to serve many different types of buyers, providing more flexibility in finding a conventional mortgage tailored to your individual situation and unique borrowing needs.

Conventional 97 Loan for First-Time Homebuyers

Fannie Mae’s Conventional 97 loan program allows first-time homebuyers to purchase property with just 3% down. There are no income limits with the Conventional 97 mortgage, although you must:

Be approved through automated underwriting

Purchase a single-unit primary residence

Obtain a fixed-rate loan

Complete a homeownership education course

HomeOne Conventional Loan for First-Time Homebuyers

Offered through Freddie Mac, the HomeOne loan for first-time homebuyers is similar to the Conventional 97 in terms of requirements and restrictions. The primary difference between these programs is simply the agency that your lender works with.

HomeReady Conventional Loan for Low-to-Moderate Income Buyers

Fannie Mae's HomeReady loan is a 3% down program designed to make homeownership more affordable for low-to-moderate income earners. You do not need to be a first-time buyer to qualify, but your total earnings can be no higher than 80% of your area median income (AMI).

In addition to a reduced down payment, HomeReady loans come with lower mortgage insurance premiums and waived loan-level price adjustments, which can result in lower monthly payments than with other types of conventional loans.

Home Possible Conventional Loan for Low-to-Moderate Income Buyers

Like the HomeReady loan, Freddie Mac's Home Possible mortgage allows you to put just 3% down as long as you make no more than 80% of AMI.

While some conventional loan programs require purchasing a single-unit property, Home Possible lets you buy a 2- to 4-unit home with a 5% down payment if you plan to occupy one of the units as your primary residence.

Note: Freddie Mac's Home Possible loan lets you purchase multi-unit residential properties with 5% down. However, recent changes to Fannie Mae guidelines allow most owner-occupants to purchase 2- to 4-unit residences with a 5% down payment. If you want to buy a multi-unit property and don’t qualify for Home Possible, apply with a lender who offers Fannie Mae loan products.

Jumbo Loans for High-Value Properties

If you’re looking to purchase a property priced higher than the conventional loan limits for your area, you’ll likely need a jumbo loan. Jumbo loans are offered by conventional lenders but do not conform to Fannie Mae and Freddie Mac standards.

For the most part, qualifying for a jumbo loan will take a higher credit score, larger down payment, and lower debt-to-income ratio compared to conventional loan requirements.

Alternate Loan Programs

Conventional loans are the most popular type of residential mortgage. Still, there are some alternate loan programs backed by the federal government that you may want to consider as well.

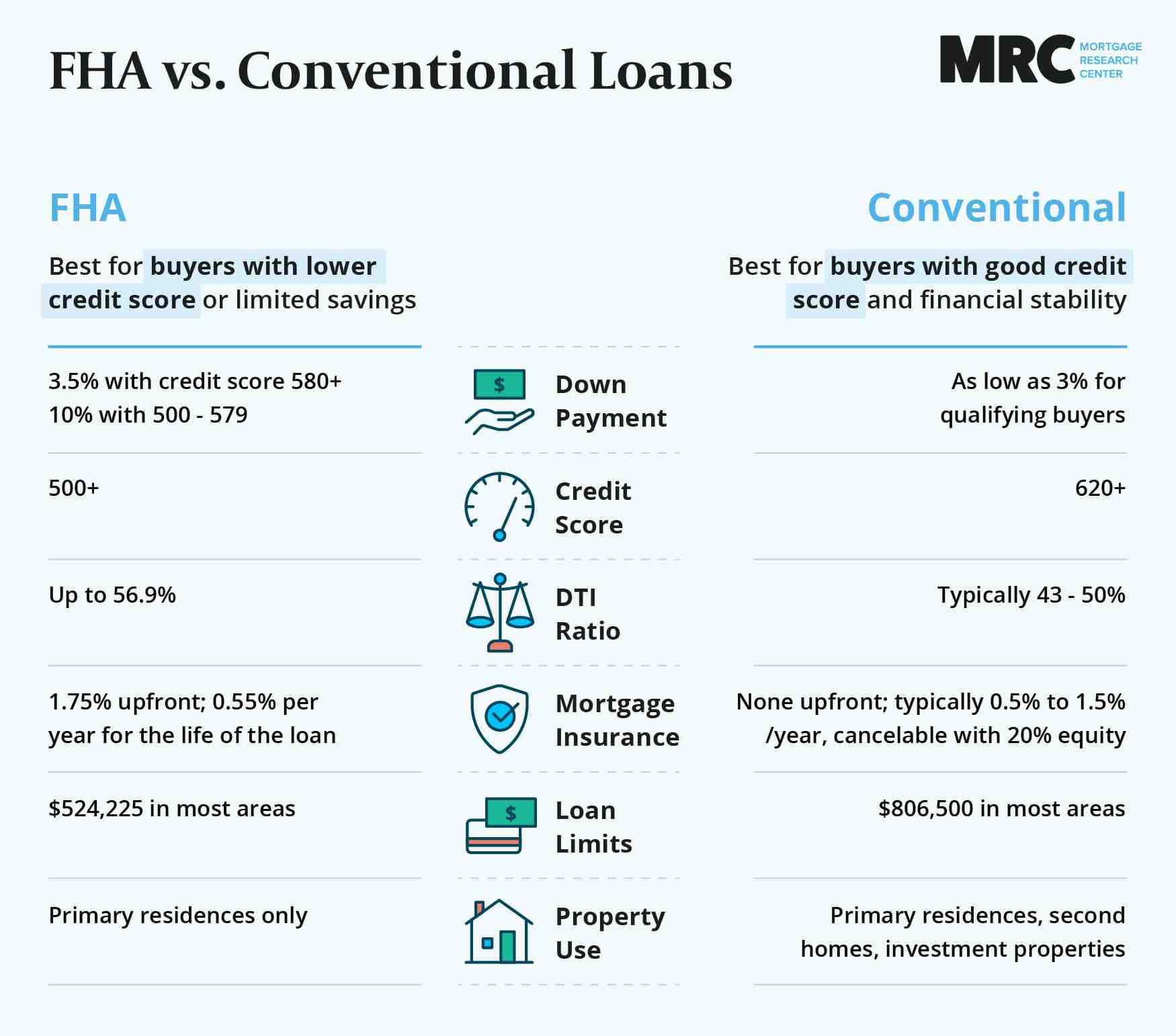

FHA Loan

FHA loans are targeted at borrowers with lower credit scores who may not be able to obtain an affordable conventional mortgage.

To qualify for a 3.5%-down FHA loan, you will need a credit score of 580. However, certain lenders may allow applicants with at least 10% down to qualify with a score as low as 500. You can also get approved through the program with a DTI as high as 56.9%.

Even borrowers who are eligible for a conventional mortgage may find cheaper payments through the FHA as the government backing often results in lower rates from lenders and mortgage insurance premiums that are less than conventional PMI.

VA Loan

VA loans are available to current and past service members who qualify for a Certificate of Eligibility from the US Department of Veterans Affairs. VA-backed mortgages tend to have lower interest rates than conventional loans and do not require any ongoing mortgage insurance.

The VA does not specify credit score or DTI requirements for its loan program, allowing each lender to set its own minimums. Plus, homebuyers with full VA entitlement can borrow up to 100% of their purchase price, meaning that no down payment is needed with most VA loans.USDA Loan

USDA loans are aimed at buyers purchasing a single-family home in a USDA-approved rural community. Similar to VA-backed mortgages, USDA loans are available with a 0% down payment. However, you must meet income limits that vary by area and household size.

Qualifying borrowers will generally find more favorable rates through the USDA. In addition, the program's upfront fee of 1% is lower than that of the FHA (1.75%), while the ongoing annual fee of 0.35% is generally less than mortgage insurance costs with both FHA and conventional lenders.

See If You Meet the Requirements for a Conventional Loan

Despite common misconceptions, it's often easier to meet conventional loan requirements than most homebuyers think. If you have a credit score of at least 620 and a 3% to 5% down payment, you're on your way to qualifying for a conventional mortgage.

To find out if you meet the full requirements for a conventional loan, as well as any other types of mortgages that may be a better fit, take a look at the current interest rates and apply with an experienced lender today.