Conventional 97 Loan. 3% Down Homebuying Without Using FHA

The Conventional 97 loan allows you to buy a home with 3% down rather than the typical 5-20% down without FHA’s permanent mortgage insurance.

Good to know: MortgageResearch.com makes money when you are matched with a lender through a web form or other connection opportunity on the site. Learn more about who we are and our editorial standards.

The Conventional 97 loan is a conventional loan program offered by Fannie Mae and Freddie Mac. A common myth is that conventional loans require 20% down, but here's a program that allows just 3% down. This option could be perfect for well-qualified homebuyers who lack a large down payment and would rather avoid FHA's permanent mortgage insurance.

This conventional 3% down option is the best of many worlds: a low down payment, cancelable mortgage insurance, and a way to make a stronger offer in competitive housing markets.

See if you qualify for a conventional loan. Start here.

Conventional 97 Advantages

The biggest advantage of Conventional 97 loans is the ability to use conventional financing with just 3% down. Many buyers seek conventional financing not only due to its cancelable private mortgage insurance (PMI), but it also gives buyer offers a more competitive edge over FHA financing. Here are other pros of conventional 3% down loans:

Cancelable PMI

No upfront mortgage insurance premium (1.75% for FHA)

3% down payment

Ability to state conventional financing on a home offer

Wide availability among lenders nationwide

Use roommate income to qualify for some loan types

Loan amounts up to $806,500

Related: What Is a Conventional Loan? And Should You Get One?

Conventional 97 Requirements

Not everyone will qualify for a 3% down conventional loan. Typically, those with strong credit, employment, and income profiles have a better chance of qualifying and receiving competitive rates and PMI fees.

Minimum 620 credit score

Maximum 45% debt-to-income ratio in most cases

3% down can come from family gifts and eligible down payment assistance programs

Must be a first-time buyer for some programs

Income limits apply for some types

1-unit homes, eligible condos, and townhomes

Property must meet appraisal requirements

Some types allow fixed-rate mortgages only

Loan must meet standard conventional loan limits of $806,500 for most of the country

Primary residences only

Homeownership education is required for most types

Limited derogatory credit

Conventional 97 vs. FHA

Neither Conventional 97 nor FHA are “better” for everyone. Each has its merits. In general:

Homebuyers with higher credit scores and a strong employment history will likely pay less overall with a conventional loan.

Those with lower credit scores or more complex financial situations might pay less and be approved more easily with FHA.

As a quick example, someone with a 640 credit score would pay more than $400 per month on a $300,000 loan using Conventional 97 but only $137 with FHA. However, someone with a 760 credit score would pay about the same for conventional PMI as for FHA mortgage insurance, potentially making a conventional loan the better choice.

The best plan is to have a lender run both scenarios for your exact situation, then weigh the current and future costs of each loan program.

Cost

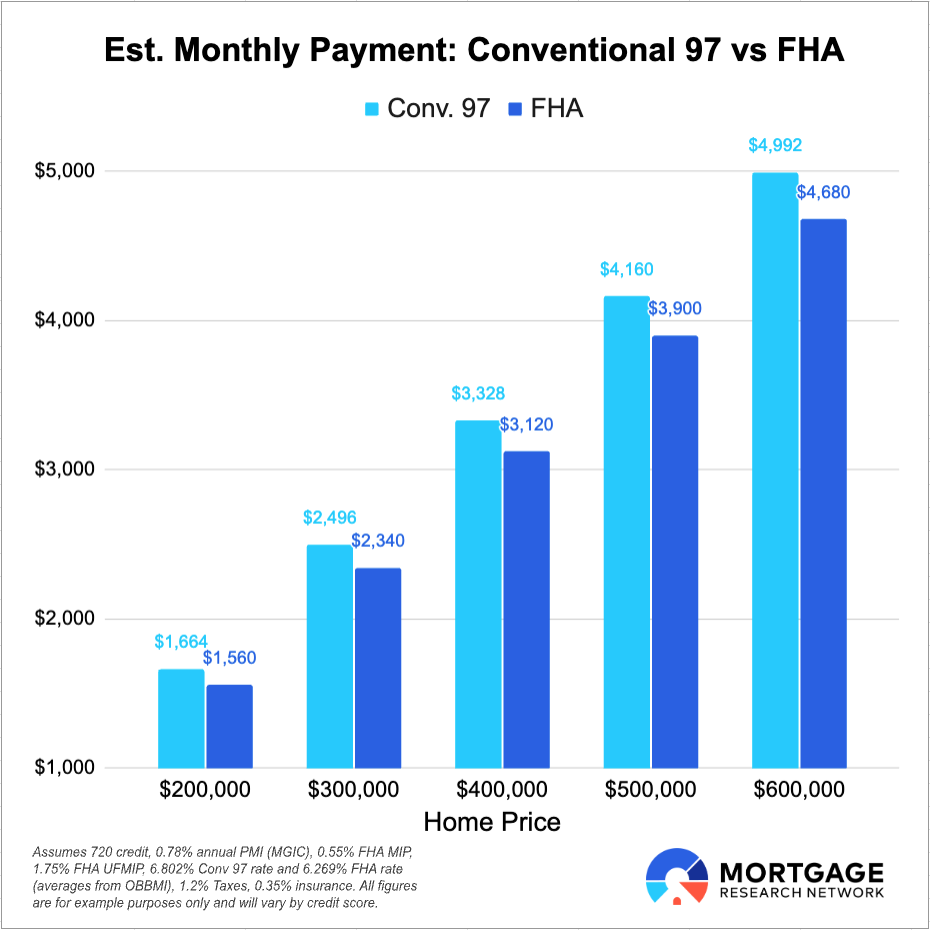

Surprisingly, FHA is the cheaper monthly option for many situations. This is due to less expensive mortgage insurance premiums and lower interest rates, thanks to strong government backing. The chart below shows the difference in monthly payments for a borrower using Conventional 97 versus FHA for someone with a 720 credit score.

Which is Better: Conventional 97 or FHA?

| Conventional 97 | FHA | |

|---|---|---|

| Down Payment | 3% | 3.5% |

| Credit Score | 620 | 580 |

| Upfront Mortgage Insurance | None | 1.75% |

| Annual Mortgage Insurance | Cancelable. Cost depends on credit score, typically 0.5%-2% of the loan amount (paid monthly) | Permanent. Typically 0.55% per year for most borrowers |

| Units | 1-unit primary residence | 1-4 unit primary residence |

| Mortgage Rates | Usually higher than FHA | Typically lower than conventional |

| Income Limits | 80% of area median income (some types) | None |

| DTI | 45% | 50-55% |

| Loan Limit | $806,500 | $524,225 (Up to $1.2M in some areas) |

| First-time Buyer | Required for some programs | No |

How to Get a Conventional 97 Loan

Getting a Conventional 97 mortgage is similar to applying for any mortgage. Some borrowers can receive a conditional pre-approval in as little as one day or a full pre-approval in a few days.

Here’s how the process works.

1. Request Pre-Approval

It may seem early, but getting preapproved lets you know how much money you qualify to borrow and any potential issues with your credit score or debt-to-income ratio you need to work on. Your lender will check your credit and credit report, request a list of debts, liabilities, and income sources, and verify your employment.

2. Save Money

Save 3% of your approved home price for a down payment, plus another 2% to 5% of the loan amount for closing costs. It’s also a good idea to have three to six months’ of mortgage payments in the bank after closing.

3. Make Offers

Your first few offers may not be accepted. Keep trying until a seller accepts your offer. Once your offer is accepted, your lender will schedule an appraisal and move your loan file into underwriting. You’ll also schedule and pay for a home inspection, which is optional but highly recommended.

4. Provide New Loan Documentation

Your loan underwriter might request updated pay stubs, bank statements, and other documents to process and provide final loan approval. You might be asked to verify large deposits or other items that the underwriter flags in the process.

5. Review the Appraisal

The lender will review the file, including the accepted offer and appraisal. Once the report comes back, you might have to make up any shortfall in the appraised value and asking price, or negotiate further with the seller.

6. Closing and Funding

Upon final loan approval, you’ll get the all-clear to close and sign your loan paperwork. You’ll wire your 3% down payment and closing cost amount to the escrow company, per the closing agent’s instructions. Once you sign the paperwork and the seller receives your funds, you’ll own the home and get those coveted house keys. Congrats!

Conventional 97 Interest Rates & Trends

See today’s conventional loan rates by entering your desired home price and other details below.

Conventional 97 Pros and Cons

Pros | Cons |

Cancelable mortgage insurance: Mortgage insurance is cancelable when you reach 20% equity in the home. | Harder to qualify: Buyers with marginal credit or spotty employment will qualify for FHA financing more easily. |

Stronger offers: Conventional financing typically increases the chances of an accepted offer. | PMI costs: Expensive PMI for those with lower credit scores. |

Flexible down payment sources: Your down payment can come from savings, a 401(k) loan, gifts from family, or eligible down payment assistance programs. | Income limits: Some conventional 3% down programs have income limits. |

Lower interest rates: First-time buyers with incomes less than 100% of their area median income may qualify for lower rates. | Higher rates: Conventional loans typically come with higher rates than FHA loans since they don’t have government backing. |

Reduced PMI: Some borrowers meeting income limits are eligible for a PMI discount. | Added restrictions: 5% down conventional loans come with lower rates, lower PMI, no income limits, and other benefits |

Widely available: Most lenders offer 3% down conventional options. | No “conforming jumbo” loans in high-cost areas. Limit is $806,500 nationwide. |

3% Conventional Loan Options

Conventional 97 loans come in a few varieties, each helping different types of homebuyers.

| Loan Program | Highlight |

|---|---|

| Fannie Mae 97 | No income limits; for first-time buyers only. |

| Fannie Mae HomeReady | Use roommate income to qualify. Borrowers must make 80% or less of their median income. |

| Freddie Mac Home Possible | Those who meet income limits qualify for reduced mortgage insurance. |

| Freddie Mac HomeOne | No income limits. |

Conventional 97 Homeownership Education Requirement

Homebuyers shouldn't be intimidated by the homeownership education requirement for most 3% down conventional programs.

Typically, these courses can be taken online and are free in some cases.

Fannie Mae offers its own free course that satisfies the requirement, called Fannie Mae HomeView®.

How Much is PMI?

Conventional 97 loans require private mortgage insurance, as do all conventional loans with less than 20% down. And because the down payment is small, mortgage insurance providers view them as a higher risk and charge higher PMI rates than for 5% or 10% down loans.

Some homebuyers are surprised that PMI can run upwards of $400 per month or more, especially for those with lower credit scores or high loan amounts.

How does Conventional 97 PMI compare with FHA mortgage insurance? As mentioned, conventional PMI can be affordable, but gets expensive for those with lower credit scores. In fact, you need at least a 760 credit score for conventional mortgage insurance to be as affordable as FHA's.

| Loan Amount | 620 | 660 | 700 | 740 | 760 | FHA, All Scores |

|---|---|---|---|---|---|---|

| $200,000 | $310 | $257 | $165 | $117 | $97 | $92 |

| $300,000 | $465 | $385 | $247 | $175 | $145 | $137 |

| $400,000 | $620 | $513 | $330 | $233 | $193 | $183 |

All figures are from MGIC and HUD, and are estimates.

Another view organized by loan program shows how conventional PMI compares with FHA mortgage insurance on a $300,000 loan.

| Loan and Down Payment | 620 Credit Score | 700 Credit Score | 760 Credit Score |

|---|---|---|---|

| FHA 3.5% Down | $137 | $137 | $137 |

| Conv. 3% Down | $465 | $247 | $145 |

| Conv. 5% Down | $355 | $195 | $95 |

All figures are from MGIC and HUD, and are estimates.

Conventional 95: A Better Deal?

A Conventional 97 Loan lowers your upfront expense, but costs more monthly, mainly due to higher mortgage insurance rates. Some buyers choose a 5% down conventional loan to reduce their monthly cost. Some save even more by putting 10% down.

Here’s another comparison of estimated monthly payments for 3% down versus 5%.

How to Pay for Your 3% Down Payment and Closing Costs

You can cover your down payment and closing costs from a variety of sources, including:

Savings: You can pull from personal checking and savings accounts or 401k via a loan or withdrawal. Another option that has gained popularity is cryptocurrency. All crypto must be converted to USD and a paper trail of ownership for the last 60 days supplied to the lender.

Your Lender: Some lenders cover part of the 3% down payment for lower-income borrowers or those buying in certain areas.

Down payment assistance: Local governments, nonprofits, and other sources offer down payment assistance (DPA). Conventional 97 allows eligible DPA providers to cover the entire down payment and closing costs.

Gifts from family: You can receive a financial gift from a relative to cover your 3% down payment and all closing costs.

Seller credits: Sellers sometimes offer closing cost assistance, called seller concessions, to the buyer. These funds can’t be used for the down payment, but can cover most or all of the closing costs. On a 3% down conventional loan, the seller can offer 3% of the purchase price in closing cost assistance.

Conventional 97 Advantages

- Cancelable mortgage insurance

- No upfront mortgage insurance

- Many sellers prefer conventional over FHA financing

- Loan amounts up to $806,500

Conventional 97 Renovation

Surprisingly, you can use a conventional loan to buy a fixer-upper, combining the home price and renovation costs into a single loan with just 3% down.

That means you can buy a home that does not currently meet financing standards as long as the repair work will correct those issues.

The work starts after closing, so to the seller, the transaction is the same as any other financed offer. And, unlike FHA rehab loans, you can install luxury amenities like outdoor barbecues, as long as improvements are permanently attached to the property.

Some conventional rehab options are:

Fannie Mae HomeStyle

Freddie Mac CHOICERenovation®

Freddie Mac CHOICEReno eXPress

Not all lenders offer conventional renovation loans, so call around to find a lender that has experience with them.

3% Down Conventional Loan FAQs

How do I apply for a Conventional 97 loan?

Most lenders offer a 3% down conventional option. Search online or call a lender you trust and apply for a preapproval. Most lenders offer online applications, but it’s worth an initial conversation with a loan officer to let them know your situation and to expect your application. Complete the application which should take 10-15 minutes, then call the lender for next steps.

Can I roll closing costs into a Conventional 97?

You cannot roll closing costs into the Conventional 97 loan. However, you can get a closing cost second loan from an approved source like city or state government. These are called community seconds.

What are the official names for the Conventional 97 loan?

Freddie Mac calls it the HomeOne® Program. Fannie Mae simply calls it the “97% LTV Standard.” These loans come with similar guidelines. Other options are Fannie Mae’s HomeReady and Freddie Mac’s Home Possible, both of which come with income limits.

Do you have to be a first-time homebuyer to use Conventional 97 or FHA?

Conventional 97 requires at least one applicant to be a first-time buyer. FHA has no first-time requirement.

What property types are acceptable on a Conventional 97?

Single-family residences, condos, and townhomes are eligible. Manufactured homes don’t usually qualify. You may not use a Conventional 97 on a second home or investment property.

I planned to put down 5% and have a pre-approval, but I would feel more comfortable with 3%. Can I change?

It’s possible if you qualify for the higher payment and lower loan-to-value. Have your lender re-run the scenario through the same computer software they used to issue the original approval to see if you are still approved with a lower down payment.

What are the income limits for Conventional 97?

Fannie Mae’s standard 97% LTV loan has no income limits, nor does Freddie Mac’s HomeOne. However, alternative options like HomeReady and Home Possible require you to make 80% or less of your area’s median income. Check your local limits on Fannie Mae’s income lookup tool.

What is the Flex 97 Mortgage Program?

The Flex 97 Mortgage is the same thing as Conventional 97. It’s how some lenders brand the 3% down conventional option.

Conventional 97 Next Steps

The Conventional 97 program can be a big help to those who want to put 3% down but don’t want FHA’s annual mortgage insurance for the life of their loan.

Start your lender search and begin your application, or do your own research on lenders before applying.