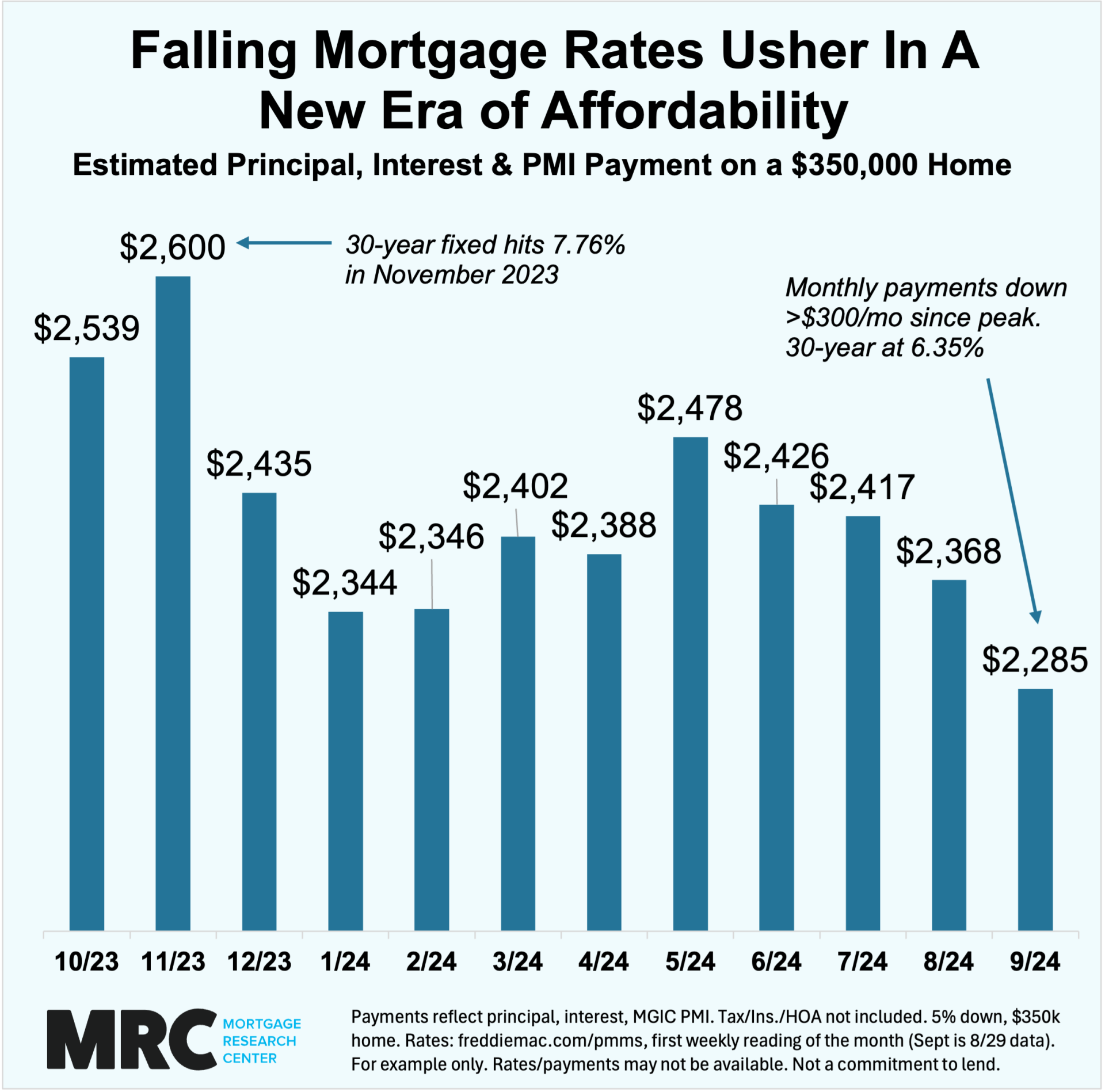

Buying a $350k Home Just Got $300 Per Month Cheaper

Homebuyers may be finally getting some relief from sky-high mortgage rates that have plagued them since early 2022.

Mortgage rates have been on an overall downward trend that has accelerated of late, as inflation eases and the economy cools.

A recent analysis revealed that the estimated mortgage payment on a $350,000 house has fallen by over $300 per month since November 2023.

The study calculated the principal and interest payment based on a 5% down loan using rates from the Freddie Mac Primary Mortgage Market Survey. Mortgage insurance from MGIC was included.

With mortgage rates easing, late-2024 could present the best opportunity to buy a home since early 2023. Not only are rates falling, but home selection is rising.

The St. Louis Fed reports that there were over 884,000 homes for sale nationwide as of July 2024. That’s approaching a post-pandemic high: inventory hasn’t been at these levels since May 2020.

HousingWire shows that eight states – Oklahoma, Texas, Idaho, Florida, Arkansas, Alabama, Tennessee, and Utah – have more inventory than in 2019, a massive reversal from the COVID years that could benefit first-time buyers.

With more inventory could come softer prices, fewer bidding wars, and less demanding home sellers.

Rising home listings, dropping mortgage rates, and late-year seasonality could be the perfect ingredients for home shoppers this fall and winter.

The Federal Reserve is expected to cut its key interest rate on September 18, potentially adding fuel to the low-rate fire.

Homebuyers who have been locked out of mortgage qualification may finally be seeing light at the end of the tunnel.