Improving your score before buying a home takes time, but is relatively simple.

Adam Godby (NMLS #2286643) is a Loan Officer and Team Lead at First Residential Independent Mortgage (NMLS #1907), a Springfield, Missouri-based national lender. Equal Housing Opportunity. First Residential is a registered DBA of Mortgage Research Center, LLC, an affiliate of Three Creeks Media.

What makes homebuyers with low credit scores different from home buyers with excellent credit scores?

Well, higher scores will put more loan options on the table. And while it is still possible to get a mortgage without good credit, people with lower scores usually have less options to mortgage approval.

But that’s not the answer. The most consistent difference I see is that people with high scores already know how credit works. That’s why they have excellent credit. People with lower scores still have a lot to learn.

For example, millions of Americans have seen their credit scores drop as student loan defaults rise again.

How I Explain Credit Score to My Clients

The first thing to know: Your credit data and your credit score are two different things:

Your credit report is information, like a research paper you’ve written in school.

Your credit score grades your credit report. It’s kind of like your teacher’s grading scale.

Let’s take this school analogy a little farther. Different teachers grade by different standards. For example, your high school teacher may give you an A on the research paper. But if you turn the same paper into a college professor, you might get a C.

Same paper. Different grade. In the same way, different credit scoring models grade your same credit data differently and will show different scores.

FICO vs Vantage Score

Only your FICO score matters to mortgage lenders. Most popular credit monitoring services track Vantage scores. Lenders who make short-term loans might check your Vantage score, but FICO works best for longer-term debts like mortgage loans.

In this article I’ll be referring to FICO scores, which tend to grade lower than Vantage and other types of scores.

I’ve met a lot of mortgage applicants who used apps to track their credit scores. They’d been tracking their Vantage scores for several years and were surprised to learn how low their FICO was.

What Makes Up a FICO Score?

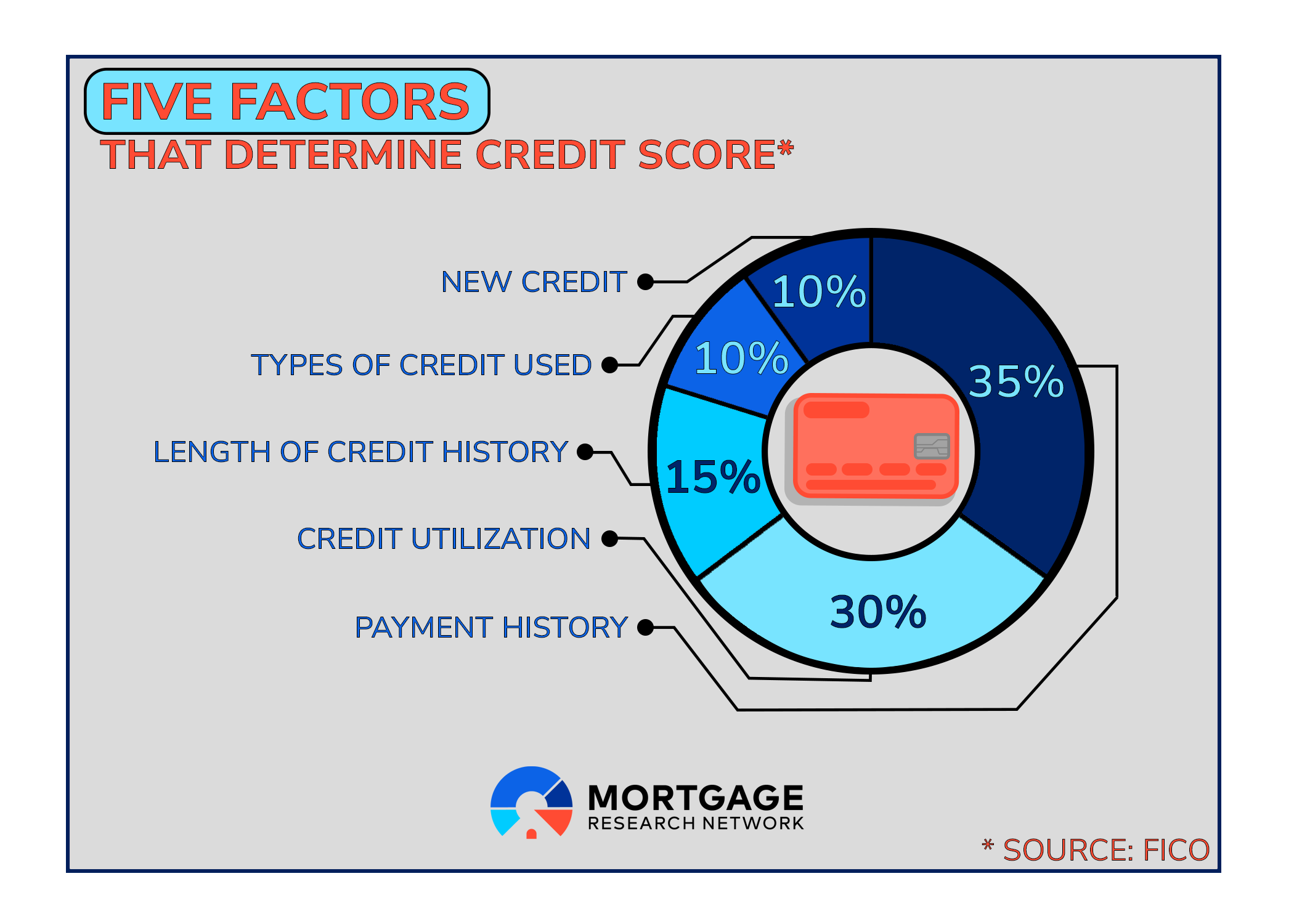

Five different variables work together to create your FICO score:

35% – Payment history: Do you pay your loan and credit card payments on time? Making late payments, or missing payments, hurts this part of your score

30% – Credit utilization: Are you using too much of your available credit? Having maxed-out credit cards hurts this part of your score

15% – Length of credit history: How new are your open accounts? Closing credit cards or using only short-term loans can hurt this part of your score

10% – Credit mix: Do you have more than one type of credit account? Closing accounts or being new to borrowing can hurt this part of your score

10% – New credit inquiries: Do you apply for credit a lot? Too many hard credit inquiries can hurt this part of your score

FICO uses this breakdown to grade the data in a borrower’s credit history. So, a borrower with excellent credit is usually someone who:

Always makes on-time payments

Keeps credit card balances low or pays off each balance each month

Has been actively using credit for several years

Uses credit cards, car loans, or other kinds of installment loans at the same time

Applies for new credit cards and loans only occasionally

Improving just one of these factors can often improve other factors at the same time. For example, someone who always pays their bills on time usually keeps lower balances without having to try.

On the other hand, someone who misses payments or makes payments 30 or more days late will often have higher account balances.

What is a Good Credit Score?

What FICO scores are good and bad?

This is how the FICO grading system breaks down:

Excellent credit: 800 to 850

Very Good credit: 740 to 799

Good credit: 670-739

Fair credit: 580-669

Poor credit: 350-579

What Credit Score Do You Need for a Mortgage?

Here’s how these numbers translate for home buyers:

Poor credit: Borrowers with poor credit scores need to improve their credit score before trying to buy a house. Guidelines may say lenders can approve FHA loans with a credit score between 500 and 579, but the down payment requirement goes up to 10 percent, and most lenders won’t lend below a 580 score anyway.

Fair credit: People with fair credit (FICO 580 to 669) can buy houses. They will need an FHA loan to get a lower monthly payment. That’s because FHA offers lower rates and mortgage insurance costs than conventional loans for those with lower credit. FHA needs only 3.5 percent down, even for borrowers with fair credit.

Good credit: FHA or conventional? This could go either way. Conventional loan rules say credit scores as low as 620 are OK, but in reality, borrowers with scores that low almost always need FHA loans. I once had a borrower with a FICO of 621 who wanted to get a conventional loan. Technically, it was possible, but to get approved, this borrower had to put 40 percent down instead of the 3.5 percent down FHA requires.

Very good credit: These types of scores create more options. Many buyers can save money by getting a conventional loan instead of FHA; some may still prefer an FHA loan because of its low down payment rules.

Excellent credit: Unless some other factor, like an inflated debt-to-income ratio, complicates the loan file, borrowers with excellent FICO scores can get approved for conventional loans with lower down payments and less expensive mortgage insurance.

All this said, mortgage lending isn’t painting by numbers. Credit score is important, but excellent credit doesn’t guarantee loan approval.

As loan officers we look under the hood, at the credit report itself, to see how the borrower has earned that score.

Getting a Mortgage with No Credit Score or Thin Credit

Having thin credit or no credit can be a big obstacle for home buying.

Thin Credit

Thin credit means you don’t have a lot of credit history. Someone who’s never applied for a loan, or someone who has only one credit card, has thin credit.

Some people with thin credit have excellent credit scores. I worked with a client recently whose credit score was in the 700s — but his credit report showed had only one credit card. Yes, he was very responsible with that card, but he had no experience juggling multiple debts.

Thin credit isn’t durable. If this client made one late payment on that credit card, his score would probably fall by 200 points. This is why FHA loans require borrowers to have at least three active credit accounts.

The fastest fix for thin credit: Adding a co-borrower who has a fuller credit history.

No Credit

These are people who don’t have any credit accounts, or they have new credit. For FICO to generate a score, a credit report must have at least six months of activity.

Someone with no credit or new credit likely can’t buy a house yet. Some lenders will accept non-traditional credit based on utility bills, rent payments, and other non-debt payments. But these loans are more difficult.

However, it’s the perfect time to start planning for the future. People with no credit should still meet with a loan officer to talk about next steps. At my company we have a team of credit counselors who can get people on the right track.

Related: How to Qualify for a Conventional Loan With No Credit Score

How to Check Your Credit Status

Like I said above, people with excellent credit usually know the ins and outs of their credit file. To get more familiar with your credit file, go to annualcreditreport.com and request your free credit reports from Equifax, TransUnion, and Experian. Don’t worry — this isn’t a shady free credit score site. It’s a federally mandated site to offer consumers more transparency into their credit profiles.

These reports won’t show a credit score. But they’ll show the data that gets scored. When you apply for a mortgage, the lender will see all this data. Why not get familiar with it yourself?

Look through the reports. Pay attention to anything that doesn’t seem right, especially errors or possible fraud. An error could be pulling down your score. Do this at least twice a year.

How to Check Your Credit Score

Ultimately, people want to know their credit score. A lot of credit card and loan providers will show your FICO score in their app or on the monthly statement. You could also pay FICO to see your score.

Again, make sure you’re checking your FICO score — at least one version of it. Even if you check a FICO 3 or FICO 8 and your lender sees your FICO 9, the scores should be similar.

Not so with Vantage scores which popular credit tracking sites show. These services are OK for tracking trends in your score, but they can give you a false sense about your credit score.

What if You Do See Errors or Fraud?

Be careful with credit report disputes. Dispute data only when you know for certain the dispute will succeed. Some people file disputes because they don’t believe they really made a late payment. Ultimately, they don’t have any way to prove the report is wrong. They just don’t like seeing the negative mark and want it removed.

Opening disputes can hurt your mortgage application. For example, an applicant with at least $1,000 in disputes automatically gets kicked to manual underwriting which takes more time and adds more scrutiny.

If a stranger’s credit data gets added to your report by mistake, or if you see evidence of identity theft, dispute the data. Otherwise, it’s best to leave it alone, especially if the negative mark is more than a year old.

Strategies to Improve Your Score

You can find credit repair companies that will help improve your score, but be wary of a service that charges by the month. When they’re charging by the month, how fast are they going to help? Credit counselors can help people improve their credit quickly.

Plus, there’s a lot you can do on your own:

Pay Loans and Credit Accounts On Time

This is huge. As loan officers, we need to see 12 months of on-time payments on all debt. Plus, on-time payments make up more than a third of your FICO score.

Do whatever it takes for you to make debt payments on time. Set reminders on your phone, or set-up automatic payments. One missed payment can hurt your credit score.

Late payments on utility bills and non-debt accounts likely won’t hurt your score right away, but pay these, too, because these can end up in collections, which do lower your score.

Avoid Opening New Lines of Credit

Generally speaking, avoid opening new credit accounts in the months before applying for a mortgage. Hard credit inquiries can lower your credit score, and too many new accounts can also result in a shorter credit history.

But, follow your loan officer’s advice if they tell you otherwise. Sometimes a new line of credit can help your mortgage application.

Keep Accounts Open

Keeping accounts open, paid off, and unused can help lower your credit utilization ratio while also helping extend the length of your credit history — both of which should be healthy for your credit score.

Get a Secured Credit Card

Someone who’s starting from scratch and trying to build a healthy credit file — or someone trying to overcome existing credit challenges — might benefit from a secured credit card.

You’ll have to secure the card with a cash deposit. The cash deposit provides the security, allowing the credit card company to issue the card even when you have bad credit.

Then, when you use the card and make on-time payments, these get reported to your credit file, building a history of on-time payments. Secured cards won’t solve all your credit problems, but they can help.

Reduce Credit Card Balances

Paying down credit card balance is a common piece of advice, and it makes sense because lower balances lower your credit use ratio, which is a big component of FICO.

But there’s more nuance here about which accounts to pay down before applying for a mortgage. A good loan officer can help you do this more strategically. Check with your lender before starting to pay down balances.

Dispute Obvious Errors

Like I said above, open credit disputes on your credit reports can slow mortgage approval, so don’t file a dispute unless it’s a slam-dunk case and you have the documentation in hand to prove it.

Here’s a good resource on how to dispute errors.

Timeline for Improving Your Credit Score

People often tell me they’re getting their credit in shape so they can apply for a mortgage. But it’s better to start the mortgage application process now, even if your credit is bad.

A good loan officer will soft check your credit (which doesn’t affect your credit score) and then go through the credit reports with you so you’ll see exactly how to improve your credit. You can learn what problems to address first and how to solve multiple credit problems at once.

My company has a team of credit specialists who excel at helping people shape up their credit quickly — sometimes within a few months, or sooner.

If you go to a lender and get zero help or a flat no without any explanation, leave and go somewhere else. Do that enough times and you’ll eventually come across somebody like me who wants to get you on the right track to buy a house as soon as possible.

How Higher Credit Scores Help Your Mortgage Terms

You can find data tables online that show what FICO score you need for different loan types. The tables look like this:

Conventional: 620

VA: 620 (set by lender)

FHA: 580 (500 with 10% down)

USDA: 620 to 640

Jumbo: 700

Like most things in life, simple numbers don’t usually reflect reality. Here’s what typically happens in real life:

Conventional Loan

Fannie and Freddie say FICO 620 is the minimum credit score to get approved for conventional borrowing.

Reality says 620 won’t do it for most people. Typical borrowers would need to make a huge down payment to get approved at 620, and that’s assuming their debt-to-income ratio (DTI) is strong.

Conventional loans also require private mortgage insurance (PMI) which can add hundreds to monthly housing costs. PMI is more expensive for riskier borrowers — aka, borrowers who barely meet the loan’s credit threshold.

FICO scores of 750 to 760 may qualify for a more affordable conventional loan.

VA Loan

The VA doesn’t set minimum credit scores for loan approval. This means lenders get to decide on their own. Typically they set this minimum at 620.

These loans have built-in insurance from the U.S. Department of Veterans Affairs. This insurance reduces the risk lenders face. With this benefit in place, borrowers could get approved with lower credit scores. This is especially true when borrowers have low debt-to-income ratios (DTIs) or when they make optional down payments. (The VA requires no down payment.)

I recommend working with a VA loan specialist, even though many lenders are authorized to approve VA loans. These loans are a benefit for veterans and active duty military members. Some surviving spouses of veterans can also use VA loans.

FHA Loan

The minimum score required for FHA is 580 for most lenders. Average borrowers, especially first-time home buyers, find their best deal with an FHA loan.

The Federal Housing Administration (FHA) provides the mortgage insurance, reducing lender risk and allowing low down payments — even for borrowers with OK credit.

Buyers do pay for their own FHA mortgage insurance, usually by adding 0.55 percent to the loan’s base interest rate. There’s also an upfront mortgage insurance fee that adds 1.75 percent to the home price.

Even with these fees, most buyers come out better with FHA, unless they have a credit score in the high 700s. Even then, some high-credit homebuyers like FHA better for some other reason. For example, sellers can pay more closing costs with FHA compared to conventional.

FHA rules say a lender could approve a loan for a borrower with a FICO as low as 500 — if the buyer puts 10 percent down. But in reality, I don’t see this happening. Very few lenders will take that kind of risk even with the FHA’s backing.

USDA Loan

Like VA loans, USDA Guaranteed loans don’t set minimum credit score requirements. Instead, lenders decide. Most lenders set minimums from 620 to 640. The U.S. Department of Agriculture provides the mortgage insurance for these loans, helping moderate-income buyers in rural areas get homes with no money down.

USDA loans have strict DTI rules since they’re designed for people with moderate incomes. A borrower needs to have low debts to get approved.

Jumbo Loan

Jumbo loans finance homes that exceed the maximum loan size for conventional loans.

By definition, jumbo loans don’t follow the rules set up by Fannie Mae and Freddie Mac, so there are no minimum credit scores set by Fannie and Freddie.

Typical lenders set their own minimums, usually around 700, but a typical buyer would need a huge down payment — think 40 to 50 percent down — to get approved with a score that low. Scores in the high 700s put buyers in a better position for approval.

Compensating Factors for Lower Credit Borrowers

Credit score matters a lot, but excellent credit alone can’t guarantee loan approval. Borrowers also need to have:

Income and employment stability: Borrowers need to show proof of steady and reliable earnings that should continue in the future

Lower debt thresholds: Debt-to-income ratio, or DTI, shows how much a borrower spends on debt each month. Lower DTIs strengthen the borrower’s loan file

Savings and assets: Loan applicants who have saved up a healthy emergency fund can keep making loan payments even if they lose their job

Higher down payment: Putting more down than required makes the loan size smaller and less risky for the lender

Showing strength in these factors can compensate for a lower credit score — as long as the borrower still meets the minimum score.

Start Now to Build Credit

Knowing how credit works, and making financial decisions with your credit history in mind, will make home buying easier and possibly more affordable.

But if you need to buy a home and you’re worried about your credit score, don’t be afraid to ask.

Applying for mortgage preapproval will show how your credit file looks from a lender’s point of view. And doing this can start a relationship with a good loan officer who can guide you through the process of getting approved for a home loan.